U.S. markets surged Monday, with the Dow Jones Industrial Average on pace for its strongest session in over three months. Value exchange traded funds took the lead, as investors jumped back to energy and other economically sensitive sectors.

“It’s a Dr. Jekyll and Mr. Hyde market. Last week it was Mr. Hyde and today it’s Dr. Jekyll coming out,” Jeff Carbone, co-founder of Cornerstone Financial Partners, told Reuters. “Today, there’s not a lot of fear out there, and that worries us more than anything else.”

Monday’s gains was a stark contrast to the rally in growth stocks last week after the Federal Reserve’s hawkish signs pointed to a shift in monetary policy and triggered the worst weekly performance of the Dow and S&P 500 in months.

Nevertheless, investors seemed optimistic about stocks, with the belief that faster growth and inflation in the coming months will continue to support the market overall, even if the long-term rate outlook rises slightly.

“For most investors, looking across the asset landscape, there still remains no alternative to equities,” Fahad Kamal, chief investment officer at Kleinwort Hambros, told the Wall Street Journal. “Hiring is happening and normality is returning, and all of that is really positive for cyclicality.”

Investors who are interested in a targeted approach to the value segment can look to the American Century STOXX U.S. Quality Value ETF (NYSEArca: VALQ). VALQ’s stock selection process includes a value score based on value, earnings yield, and cash flow yield, along with a sustainable income score based on dividend yield, dividend growth, and dividend coverage.

The American Century Focused Large Cap Value ETF (FLV) tries to achieve long-term returns through an investment process that seeks to identify value and minimize volatility. FLV holdings and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets.

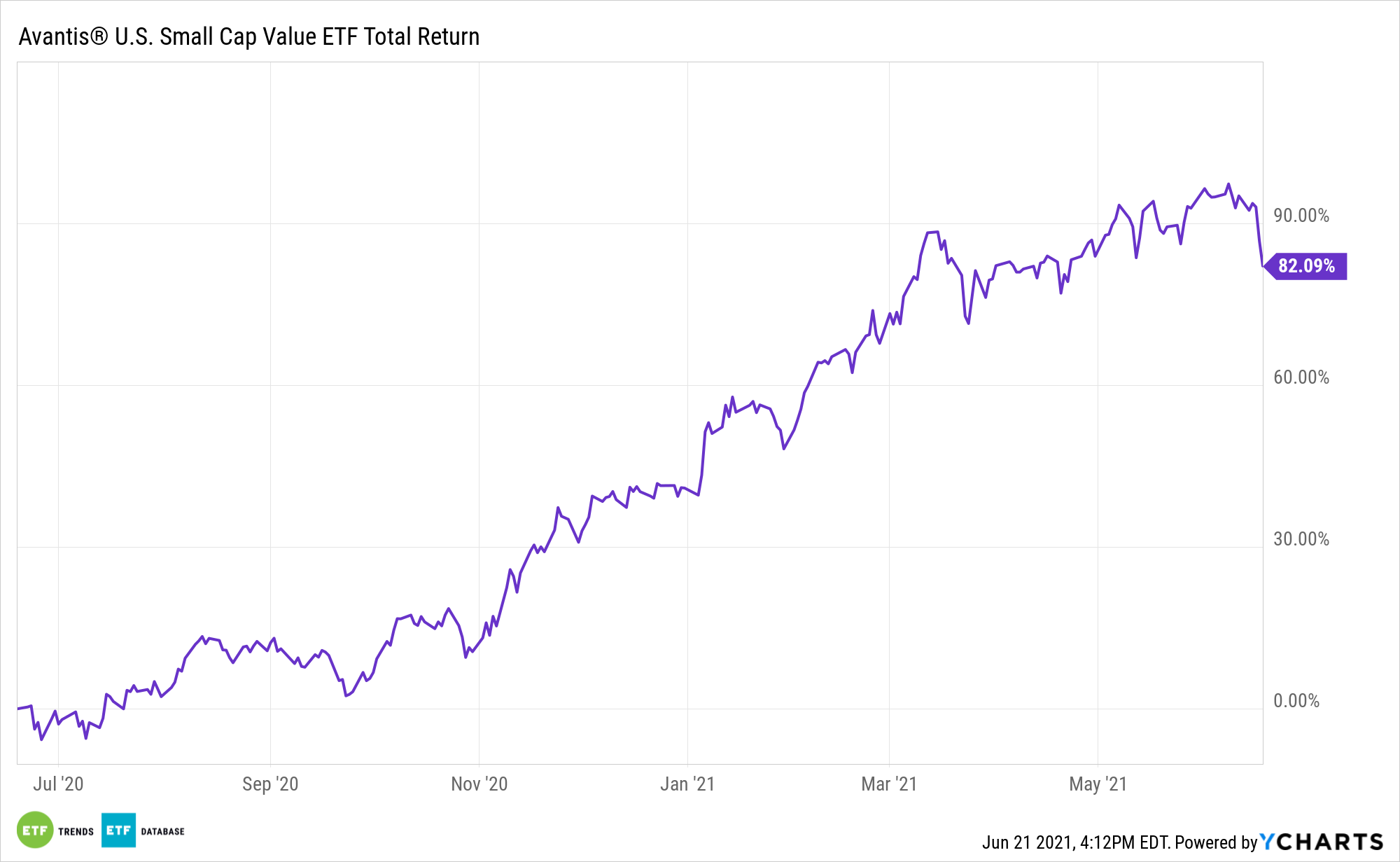

Lastly, the Avantis U.S. Small Cap Value ETF (AVUV), an actively managed ETF, seeks long-term capital appreciation. The fund invests primarily in U.S. small cap companies and is designed to increase expected returns by focusing on firms trading at what are believed to be low valuations with higher profitability ratios.

For more news, information, and strategy, visit the Core Strategies Channel.