Many market participants are aware that e-commerce is one of the epicenters of technological disruption, but they may not be aware of the extent of that disruption and the full opportunity set offered thanks to shifting consumer habits.

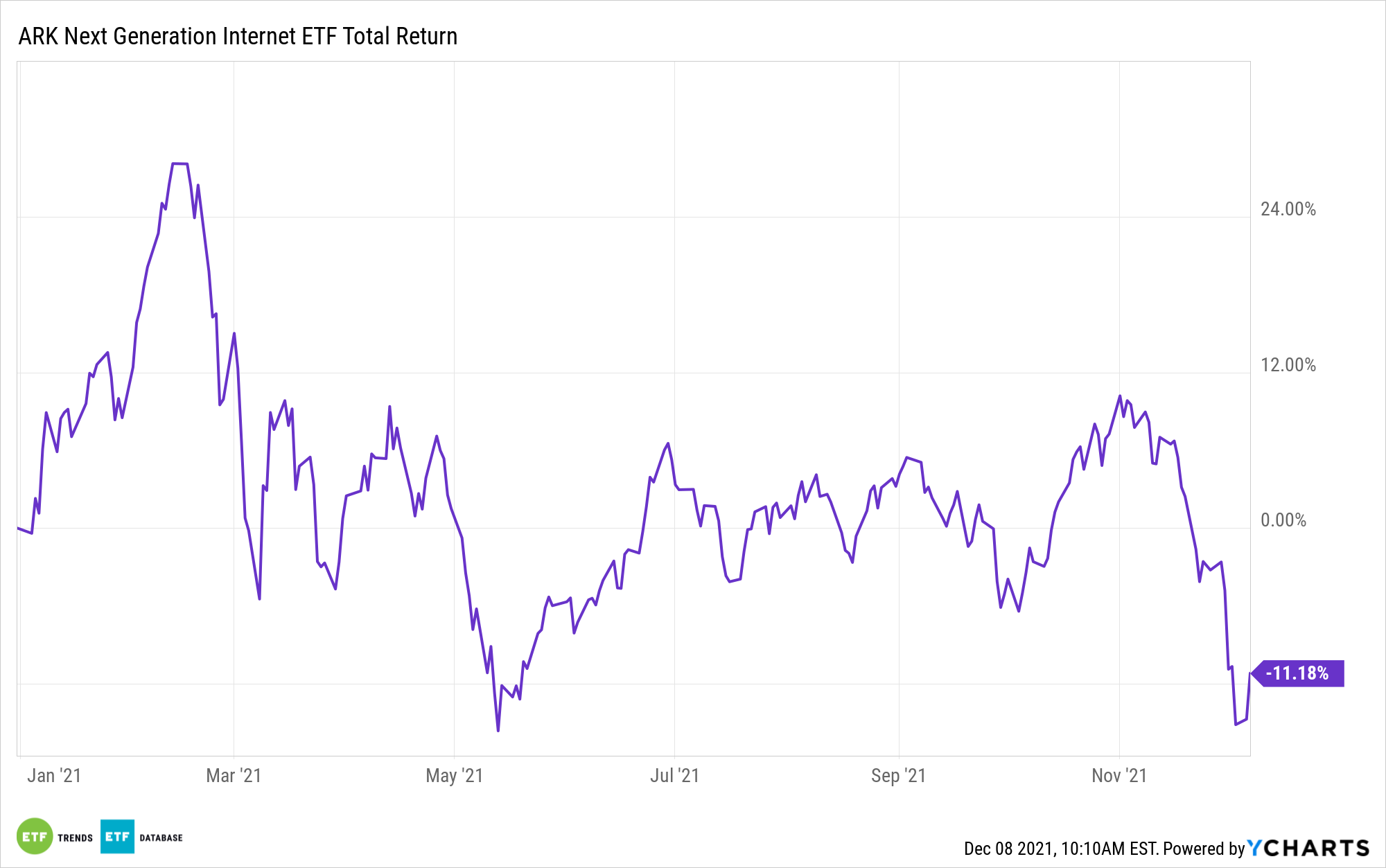

Some exchange traded funds put investors front-and-center with those trends. That group includes the ARK Next Generation Internet ETF (NYSEArca: ARKW). Today, some market observers believe that consumerism is at an inflection point and that old retail concepts are destined to become even more obsolete.

Due in large part to the spectacular growth of e-commerce, the convergence of consumer habits and technology “is now becoming normalized. eCommerce is at an inflection point: Over the next four years, it will grow more than three times faster than physical retail, data from Activate Consulting suggests. This is creating new opportunities and transforming the way brands are marketing and selling their products,” according to BlackRock research.

ARKW is relevant against the backdrop of changing retail trends because it’s actively managed, implying some level of versatility. Indeed, ARKW is versatile. In fact, its largest sector allocation isn’t consumer discretionary. It’s technology, at 34.4%. Combine that with a 23.7% allocation to communication services, and ARKW is more than adequately levered to new consumer trends.

At the industry level, ARKW’s 34.1% combined weight to digital media and e-commerce equities is practical in terms of capitalizing on shifts in consumer habits, but the fund’s exposures to blockchain and cloud computing equities, among others, are relevant as the retail/tech marriage expands and encompasses new themes, including entertainment.

“Online entertainment is soaring as well. Advancements in high-speed networks and the rise of the internet allow unfettered access to digital content whenever and wherever. And consumers are eating it up: People in the developed world spend more time interacting with their friends on social media and gaming platforms than in real life,” adds BlackRock.

Less than 23% of ARKW’s holdings are mega-caps, indicating that it has some leverage to tomorrow’s next big starts in retail, and that’s important because the aforementioned trends are proving sticky.

“And importantly, these trends are independent of the economic cycle. For that reason, she sees them only gaining in importance over the next several years. Who will be left behind? Companies and industries that have been slow to invest in digitalization,” concludes BlackRock.

For more news, information, and strategy, visit the Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.