A constructive economic outlook alongside heightened geopolitical risk contributes to foundational support for oil prices this year. When looking to increase oil and energy sector exposure, investors should ensure they don’t overlook midstream.

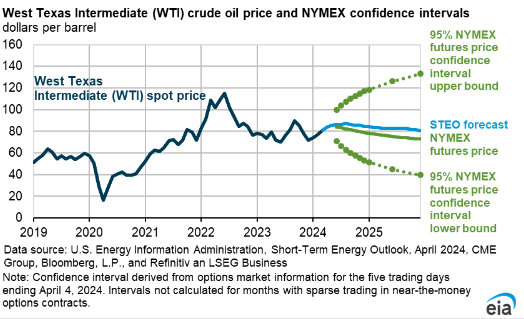

As the macroeconomic outlook improved in the first quarter, oil prices climbed higher. WTI crude prices increased 16.1% in Q1 with expectations for heightened demand, driving price forecasts higher.

“We forecast the Brent crude oil spot price will average $90 per barrel (bbl.) in the second quarter of 2024,” the U.S. Energy Information Administration wrote in an April update. It’s a gain of $2/bbl. over last month’s estimates for the global oil benchmark. “This increase reflects our expectations of strong global oil inventory draws during this quarter and ongoing geopolitical risks.”

Alongside increased prices, the EIA also increased global oil consumption estimates by 0.4 million barrels per day this year.

Image source: EIA

The U.S. economy continues to prove resilient in the face of persistent inflation. The International Monetary Fund revised its GDP estimates for many developed nation economies this month, including the U.S.

Real GDP growth estimates for the U.S. rose to 2.7% this year, up from last year’s 2.5% growth. Meanwhile, emerging market GDP estimates remain strong with a real GDP growth estimate of 4.2% this year.

Capturing Oil and Energy Momentum With Defensive Positioning

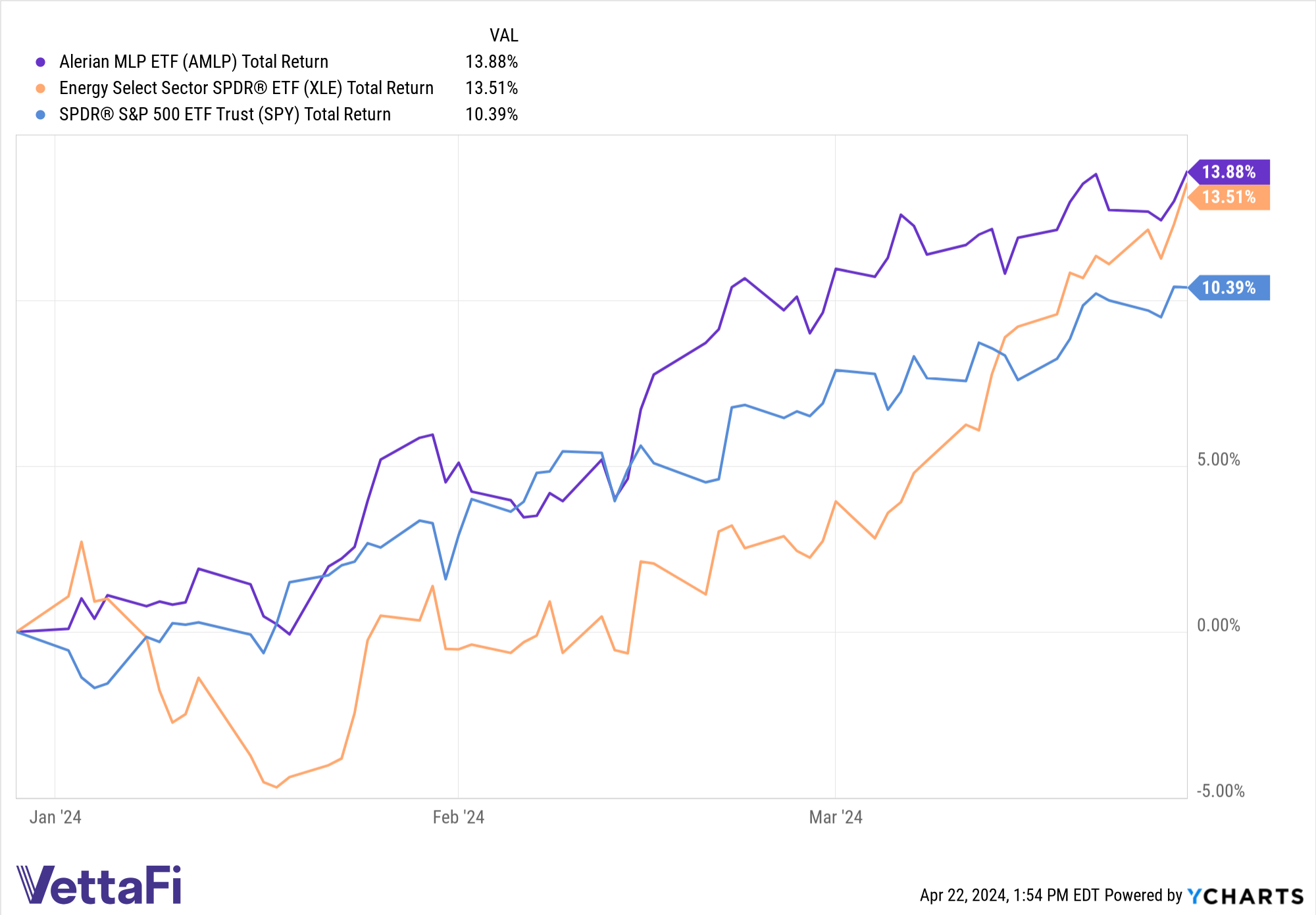

Ongoing economic growth creates a constructive backdrop for energy. The energy sector is the top-performing S&P sector year-to-date as of 04/19/22, according to Y-charts data.

Investors wanting to ride the oil and energy rally, while collecting attractive dividends, should also look to midstream exposure and Master Limited Partnerships (MLPs). Midstream MLPs are responsible for storing, processing, and transporting oil and natural gas.

MLPs’ fee-based business structures provide less exposure to commodity prices. This means midstream companies generate more stable cash flows within energy and offer defensive positioning against commodity price volatility and drawdowns.

In the first quarter, the Alerian MLP ETF (AMLP) outperformed both the S&P 500 as well as the broad energy sector.

The fund has provided year-to-date total returns of 12.51% as of 04/19/2024. AMLP generated a 7.35% trailing 12-month yield and an indicated yield of 7.5% as of 04/19/2024. Indicated yield annualizes the most recent dividend and is divided by the current stock price, providing a more forward-looking measurement.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP, for which it receives an index licensing fee. However, AMLP is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP.

For more news, information, and analysis, visit the Energy Infrastructure Channel.