By Holly Framsted, CFA, Managing Director, US Head of Factor ETFs, within BlackRock’s ETF and Index Investments Group

Key takeaways

- Uncertainty looms headed into closely watched 2020 U.S. elections

- The potential for a contested election outcome raises the specter of market volatility, but timing markets is difficult, and investors could miss out if they rush to the sidelines and cash

- Minimum volatility and quality factors, diversified equity indexes and broad fixed income indexes and can potentially help investors to weather volatility and stay invested

The final stretch of the 2020 U.S. election season — Nov. 3 is fast approaching — feels loaded with uncertainty.

As always, control of the White House and Congress are up for grabs as voters express their preferences for U.S. policymaking in the years ahead. But unlike any election cycle in our lifetimes, this one is playing out in the middle of a pandemic and economic recession.

What’s more, the BlackRock Investment Institute sees a material risk of a contested election or a delayed result. A jump in mail-in voting could complicate vote counting, delay results and trigger legal challenges. Brace for an election week, or longer — and don’t expect to be rewarded with results by staying up late into the night.

For investors, one consequence may be the potential for heightened volatility across financial markets.

Time in the market, not timing the market

Investors are likely thinking about how or whether to re-position portfolios in anticipation of an upswing in volatility related to the outcomes of the 2020 election. And it’s common for investors to act on election-related worries by dialing back on risk and selling stocks. Flows into money market funds have accelerated in presidential election years since 1993; in keeping with the three-decade trend, money market funds, have seen a surge this year as well — although the effects of the coronavirus-induced market shock are of course a factor.1

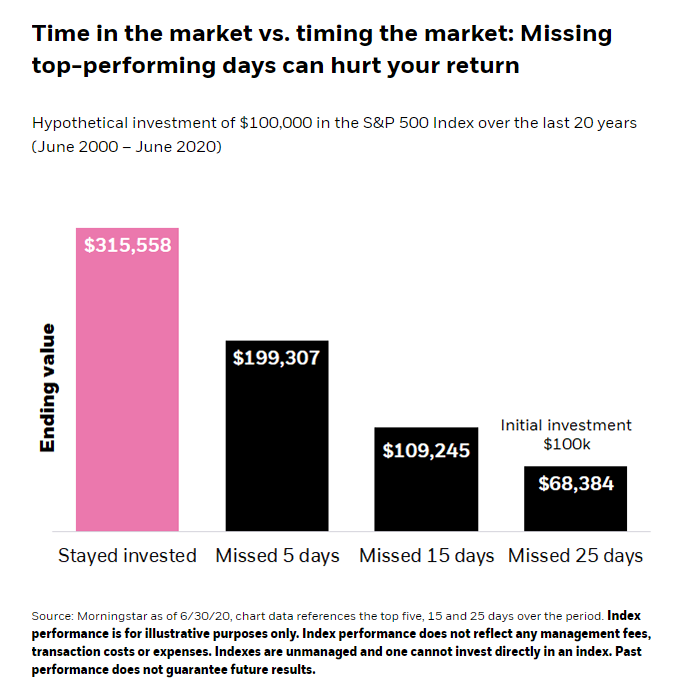

Successfully timing the market — buying and selling at just the right times — is difficult even for the most experienced investor. In the face of uncertainty, there’s a temptation to stay on the sidelines, sitting in cash to avoid big market declines while waiting for the unknown to play out. However, this seemingly intuitive strategy may cause investors to miss out on gains when down markets snap back. Missing even a handful of top-performing market days can significantly weigh down overall returns.

A bit of historical perspective is always helpful when thinking about financial markets. U.S. stocks have fared well over the long term and throughout different administrations. Importantly, markets have continued to trend positively over time, and the power of compounding returns means that for the long-term investor, a focus on managing volatility and simply remaining invested may prove more powerful than reactions to a given administration.

Managing market volatility (without going headlong into cash)

Consider three strategies when it comes to managing portfolios through bouts of uncertainty:

- The first strategy involves factors, the persistent and well-documented asset characteristics that have historically driven investment risk and return, to maintain exposure to stocks while also potentially adding resilience to help manage drawdowns. Funds that seek to track minimum volatility stock indexes allow investors to access a balanced portfolio of stocks that displays lower overall risk to the broad market; funds that seek to track quality stock indexes allow investors to target shares of profitable companies with low leverage and stable earnings. While the quality factor does not explicitly target lower volatility, a focus on high-quality firms has the potential to balance capturing upside and limiting downside.

- Another strategy is focusing on what matters most — a strong portfolio foundation. A strong foundation means focusing on the long term and maintaining sufficient diversification to withstand whatever comes next. Broad-based equity indexes can work well as building blocks in this regard since investors can target entire regions but remain relatively diversified by virtue of owning a basket of hundreds of stocks.

- Last, it may make sense to reevaluate whether portfolios contain enough bonds to diversify equity risk. Pivotal events such as elections are opportunities to check and potentially recalibrate comfort levels on stock/bond mix; if an investor is truly worried about power changes inside the Beltway, perhaps it’s time to consider modifying that 70/30 to a 60/40 – especially if it allows you to sleep at night. Broad fixed income indexes can help provide portfolio ballast or allocation to US Treasury bonds, which experience a flight-to-quality when stocks sell-off.

Summing it up

To be sure, market volatility related to the upcoming election can throw investors for a loop, and even the best-designed portfolios can be susceptible to market ebbs and flows. But investors do have options for building resilience into portfolios using factors, fixed income and broad-based equity indexes to help stay on track with their long-term goals.

Related ETFs

iShares MSCI USA Min Vol Factor ETF – USMV

iShares MSCI USA Quality Factor ETF – QUAL

iShares MSCI Intl Quality Factor ETF – IQLT

iShares Core S&P Total U.S. Stock Market ETF – ITOT

iShares Core U.S. Aggregate Bond ETF – AGG

iShares Core Total USD Bond Market ETF – IUSB

iShares International Treasury Bond ETF – IGOV

1. Morningstar as of 6/30/20. Money funds, stock funds, and bonds funds are represented by their respective U.S. fund categories as defined by Morningstar. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics (“factors”). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying index’s strategy of seeking to lower volatility will be successful.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial advisors for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Barclays, Bloomberg Finance L.P., BlackRock Index Services, LLC, Cohen & Steers Capital Management, Inc., European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Services, LLC, India Index Services & Products Limited, JPMorgan Chase & Co., Japan Exchange Group, MSCI Inc., Markit Indices Limited, Morningstar, Inc., The NASDAQ OMX Group, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), New York Stock Exchange, Inc., Russell or S&P Dow Jones Indices LLC. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE nor NAREIT makes any warranty regarding the FTSE NAREIT Equity REITS Index, FTSE NAREIT All Residential Capped Index or FTSE NAREIT All Mortgage Capped Index; all rights vest in NAREIT. Neither FTSE nor NAREIT makes any warranty regarding the FTSE EPRA/NAREIT Developed Real Estate ex-U.S. Index, FTSE EPRA/NAREIT Developed Europe Index or FTSE EPRA/NAREIT Global REIT Index; all rights vest in FTSE, NAREIT and EPRA.“FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2020 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

ICRMH1020U-1366812-7/7