By Garrett DeSimone, Ph.D., Head of Quantitative Research, OptionMetrics

Beyond Meat (BYND) has become the hottest IPO of 2019, racking up peak returns of 800% during the first months of its listing. While the stock has retreated from astronomical price levels, many investors remain bullish on its growth potential as it has secured major supply chain contracts with KFC and analyst upgrades at JPM.

The nature of IPO investing is inherently risky. Beyond Meat has an astronomical valuation it must grow into, a long list of potential competitors, and concerns regarding nutritional value of its product compared to beef. But for bears, betting against this stock is not a cheap endeavor.

Stock borrow fees represent the cost of financing a short position in an underlying stock. For liquid, large companies these costs are generally low and stable, averaging around 0.5% yearly. But for companies with a limited supply of shares these fees are substantial, in some cases making the stock nearly impossible to borrow.

Quoted option prices embed information about the implied future borrowing costs associated with a security. Option market makers short underlying stock in order to maintain delta hedges on long call positions. The cost of carry is priced as a larger premium on put options since these derivatives can act as synthetic shorts. These implied rates are predictive of future changes in actual borrow costs.

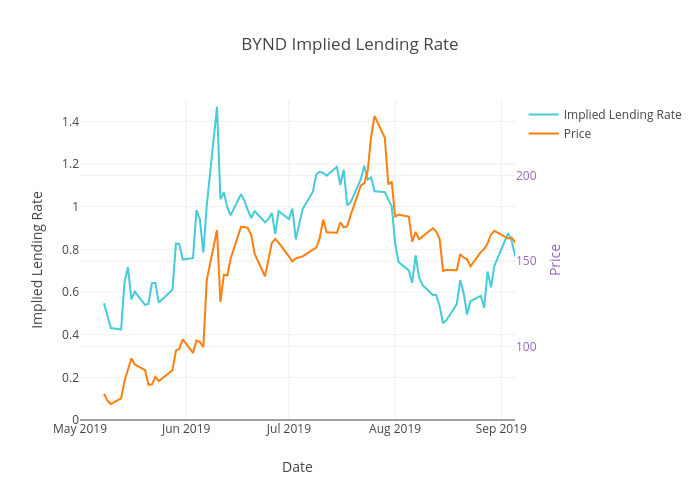

The graph below presents the near-term implied lending rate for BYND. There is no free lunch when it comes to shorting BYND. Currently, shorts are paying upwards of 80% fees on their total notational position, meaning any bearish investor must have serious conviction about the stock taking a downward spiral.

That presents the question, do high lending rates provide an indication about the longer-term performance? Financial theory tells us stocks with large borrows precede poor performance. The story of another infamous IPO (SNAP) supports this notion:

SNAP lending rates spiked in mid-July and eased once shares become more readily available to short at the end of the lock-up period in August. However, the stock price continued its plummet until Dec 2018 to nearly $5 a share marking a crushing -80% loss to initial investors. The relationship between borrow rates and poor performance can be understood from a simple economic perspective. An asset that cannot be shorted or has high costs of doing so will be overpriced. And, the few investors willing to absorb those costs are likely highly committed arbitrage traders willing to bear the risk of short squeezes.

Substantially high implied lending rates do not support a long-term bullish thesis for BYND. However, shorting the stock today carries high financing costs and significant near-term risks due to potential short squeezes from a limited supply of shares. Like the SNAP IPO, the end of the lock up period occurring in October can be the catalyst for the stock to tailspin, as insiders can dump shares. This new availability of collateral would in turn ease rates, making the short sale proposition more profitable.

Garrett DeSimone, PhD, is head of Quantitative Research at OptionMetrics, an options database and analytics provider for institutional and retail investors and academic researchers that has covered every U.S. strike and expiration option on over 6,000 underlying stocks and indices since 1996. It also offers historical options databases for Canada, Europe, Asia, and global indices. DeSimone can be reached at [email protected]