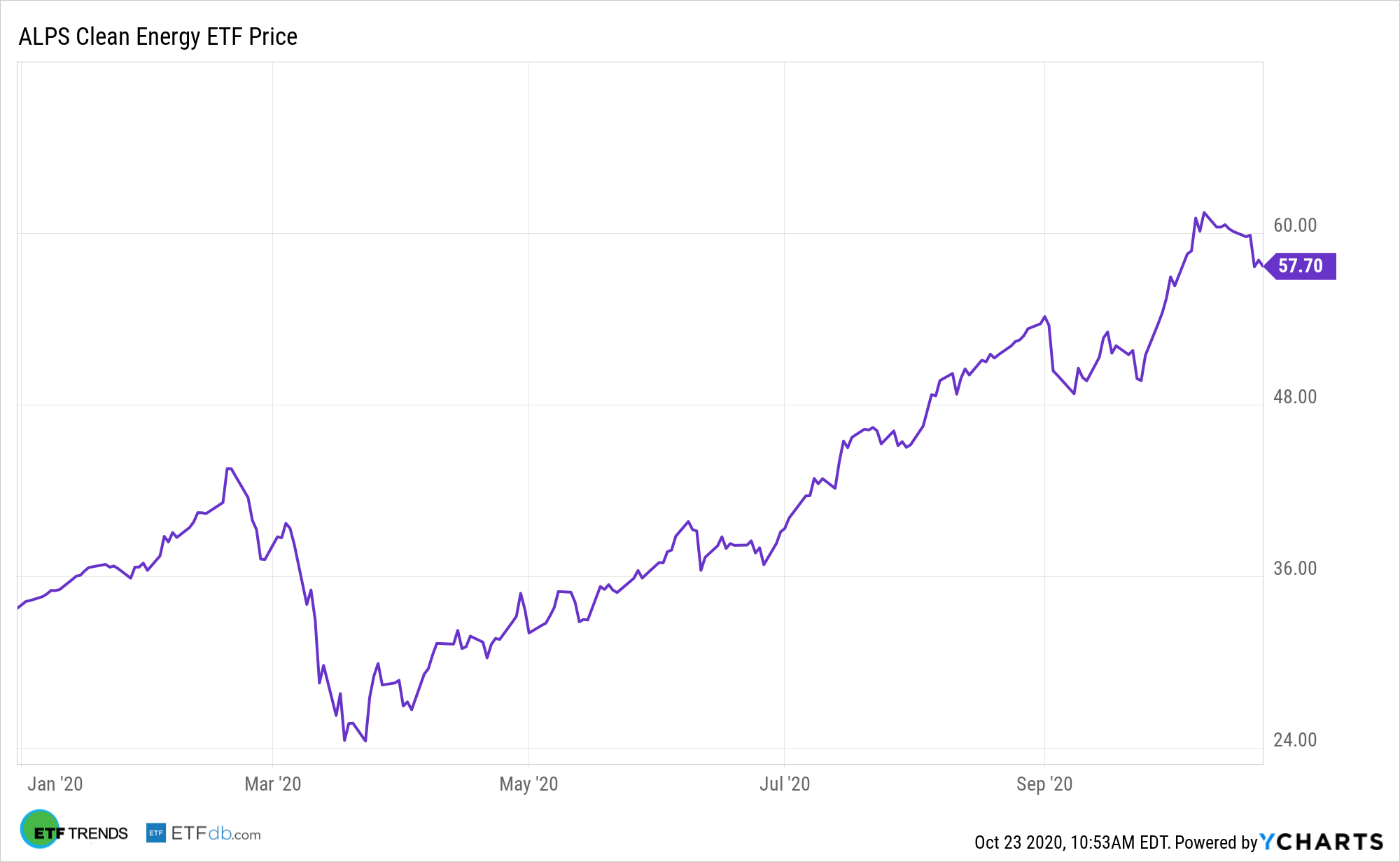

The ALPS Clean Energy ETF (ACES) is among the renewable energy exchange traded funds delivering stellar returns this year and while some data suggest this group of ETFs is levered to positive polling numbers for Democratic nominee Joe Biden, ACES doesn’t need a specific electoral outcome to be a long-term winner.

After all, the ALPS fund is performing well while President Trump is in the White House, indicating the political sensitivity of clean energy stocks is often overstated. Moreover, there are other trends bolstering the case for renewable energy assets.

ACES’ solar components included companies that derive a significant amount of their revenues from the following business segments of the solar industry: solar power equipment producers including ancillary or enabling products. Declining costs a low interest rate in the U.S. are bolstering the case for solar equities, propelling ACES higher in the process.

Obviously, Trump isn’t the biggest clean energy supporter, but it’s also obvious that ACES is soaring while he’s in the White House and it’s also clear the fund was performing well in advance of former Vice President Joe Biden revealing his ambitious alternative energy agenda.

ACES Doesn’t Need Political Help

The growth of wind and solar, which isn’t driven by the president, is relevant to ACES because the fund allocates about 45% of its total weight to companies in those industries. Investor sentiment matters, too.

“A significant shift in investor sentiment toward renewables already took place earlier this year when the collective market cap of clean energy stocks surpassed that of oil giant ExxonMobil,” according to U.S. Global Investors. “The clean energy group—which includes companies like Vestas Wind Systems, Plug Power, Sunrun and Siemens Gamesa Renewable Energy (SGRE)—is now valued at just under $200 billion, compared to Exxon at $145 billion. That’s down substantially from a market cap of half a trillion dollars in 2007.”

Underscoring the point that ACES doesn’t need Biden or any other politician to win is that domestic renewable energy adoption is often driven at the state level and there are deep international implications here, too.

ACES follows the CIBC Atlas Clean Energy Index. That benchmark is comprised of U.S. and Canada-based companies that primarily operate in the clean energy sector. Constituents are companies focused on renewables and other clean technologies that enable the evolution of a more sustainable energy sector.

Other alternative energy ETFs include the First Trust Global Wind Energy ETF (FAN) and the SPDR Kensho Clean Power ETF (CNRG).

For more on cornerstone strategies, visit our ETF Building Blocks Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.