The interest rate narrative remains complex, with conflicting economic data resulting in an ever-shifting tide of investor sentiment. For investors looking to capture income opportunities through high quality bonds, the Fidelity Investment Grade Bond ETF (FIGB) is a fund to consider.

FIGB recently crossed the three-year mark since its inception, having launched in March 2021. The fund seeks high current income by investing largely in quality investment-grade bonds.

For investors looking to move out of cash or short exposures and into longer duration bonds, FIGB’s quality focus makes it a potentially attractive addition to portfolios. The strategy invests primarily in medium- and high-quality investment-grade bonds while offering diversified exposure across sectors. More than two thirds of the fund’s holdings were U.S. government securities and or carried AAA ratings as of the end of March 2024.

FIGB Offers Multi-layered Diversification Within Bonds

The team uses fundamental, research-based inputs, issuer and sector valuation, and individual security selection as it seeks to generate risk adjusted outperformance in a variety of market environments.

The fund seeks to have broad diversification across the investment grade fixed income landscape making it a core bond holding which seeks to provide income generation and diversification relative to equities.

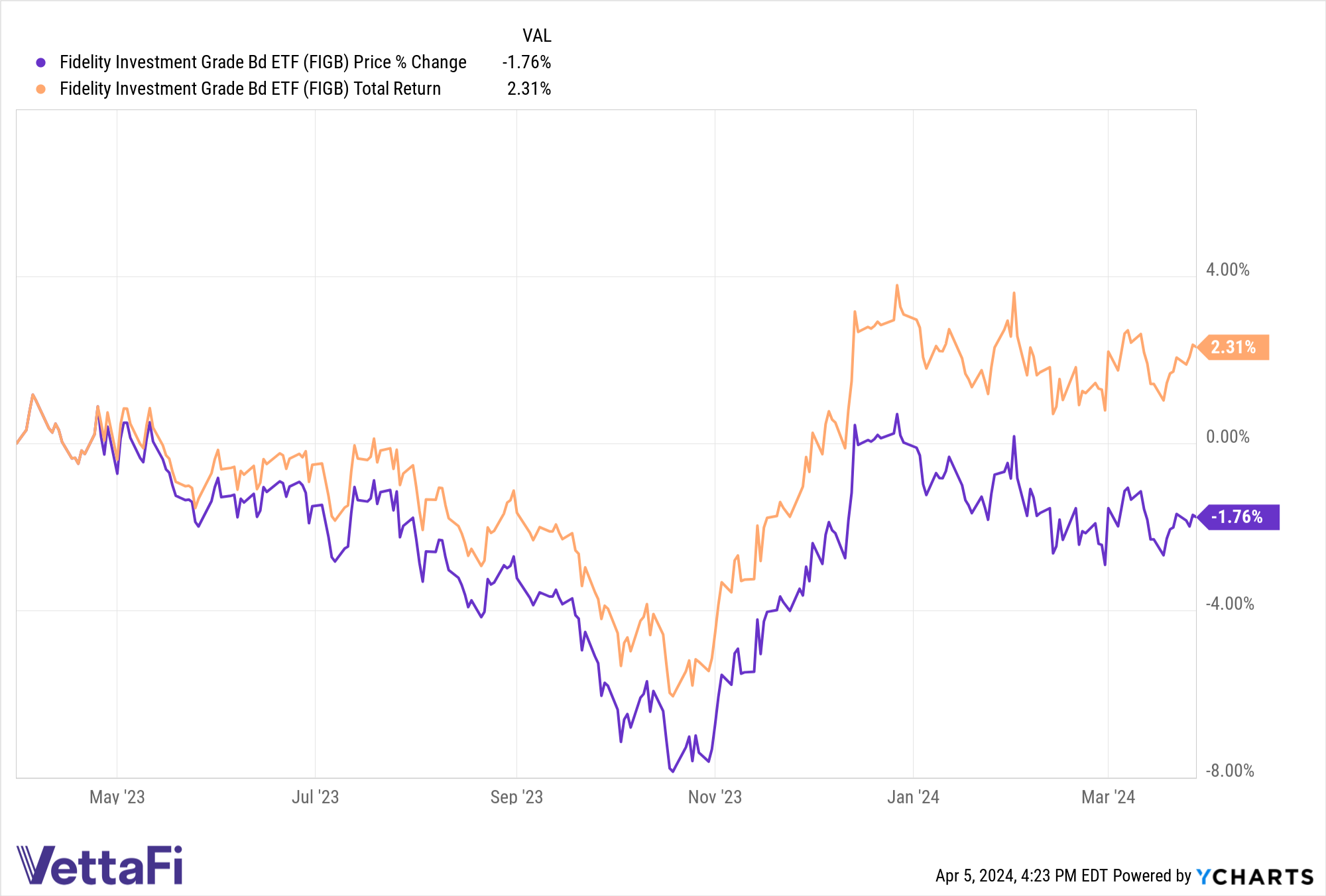

FIGB gained 2.1% on a total return basis between the end of Q1 2023 and the end of Q1 2024. The fund currently trades above its 200-day Simple Moving Average but below its 50-day SMA YTD as of 04/04/24, according to Y-charts data. FIGB generated a 4.72% 30-day SEC yield as of 04/04/24 with an expense ratio of 0.36%.

For more news, information, and strategy, visit the ETF Investing Channel.

Fidelity Investments® is an independent company, unaffiliated with VettaFi. There is no form of legal partnership, agency affiliation, or similar relationship between VettaFi and Fidelity Investments. Nor is such a relationship created or implied by the information herein. Fidelity Investments has not been involved with the preparation of the content supplied by VettaFi. It does not guarantee, or assume any responsibility for its content.

1144258.1.0