By Chris Konstantinos, CFA, RiverFront Investment Group

SUMMARY

- European economies are belatedly catching up to the US.

- We believe this is due to increased vaccinations and stimulus.

- The region is now improving enough for us to consider adding some exposure.

US Still the Strongest Economy, but Europe Belatedly Catching Up

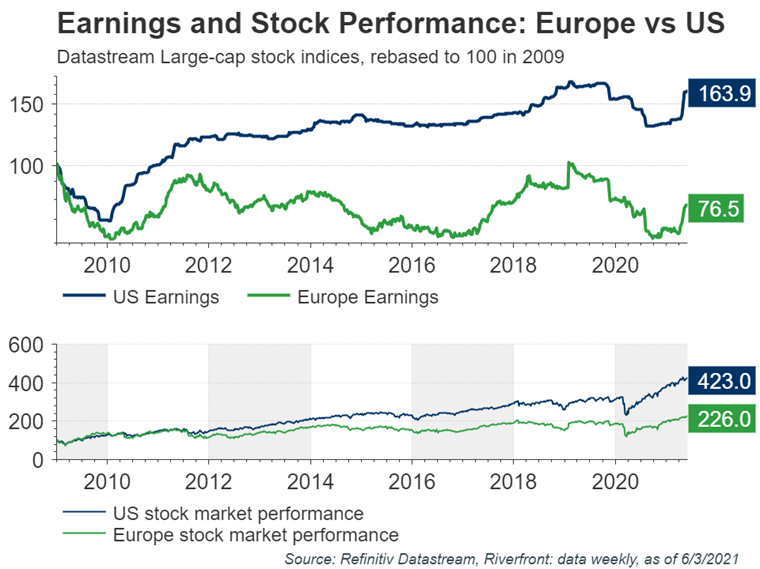

Is Europe finally starting to turn around? This is a question we have been fielding a lot from investors recently, as the MSCI Europe index is up almost 15% year to date. Europe reminds us of that consummate slacker we all knew from school; possessing promise but lacking the desire and impetus to get their proverbial act together. Since the Global Financial Crisis (GFC) ended in 2009, we have repeatedly witnessed Europe underachieve the US in economic growth as well as in corporate earnings, leading to meaningful stock market underperformance (see chart below). The region’s issues are multifaceted and include political fissures, historical enmity among countries, a lack of structural reform, and poor demographics. Furthermore, Brexit has challenged the permanence of the European Union (EU), and the role of the European Central Bank (ECB) remains unresolved without a pan-European bond market with regional risk-sharing.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

While Europe’s structural problems appear far from resolved in our opinion, stock markets in the near term tend to trade around changes at the margin. Sometimes the most positive stock markets to be involved in are the ones where the fundamental news is going from ‘terrible’ to merely ‘bad’. A recent example is the remarkable performance of the US stock market since the summer of 2020, when forward looking economic indicators and earnings revisions first started to show glimmers of bottoming. Adding to the allure of Europe is a potential for a ‘catch-up’ trade, given our view of the region’s more attractive valuation metrics.

We see evidence that Europe is improving enough at the margins to consider adding to weightings, especially for investors who find themselves significantly underweight Europe. Our balanced portfolios currently have a small underweight to the region and we are monitoring the fundamental backdrop closely for further signs of improvement.

Europe Checklist: Improvement at the Margins

COVID-19 Vaccination Distribution: Europe improving after a very slow start

-

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

In our Weekly View: US is the Still the Economic King of the Hill (published 04.27.2021), we posited that the US remains the strongest major economy coming out of the pandemic.

- We believe that this at least in part has to do with the US’s much faster distribution of COVID-19 vaccines, which allowed the US economy to reopen quickly. While the UK resembled the US experience, the EU in general was much further behind in Q1 and early Q2.

- However, Europe is starting to catch up in terms of vaccine distribution, which we believe should aid their economic recovery going forward (chart, right).

Business Sentiment: Europe rebounding strongly, following the US’ lead

-

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

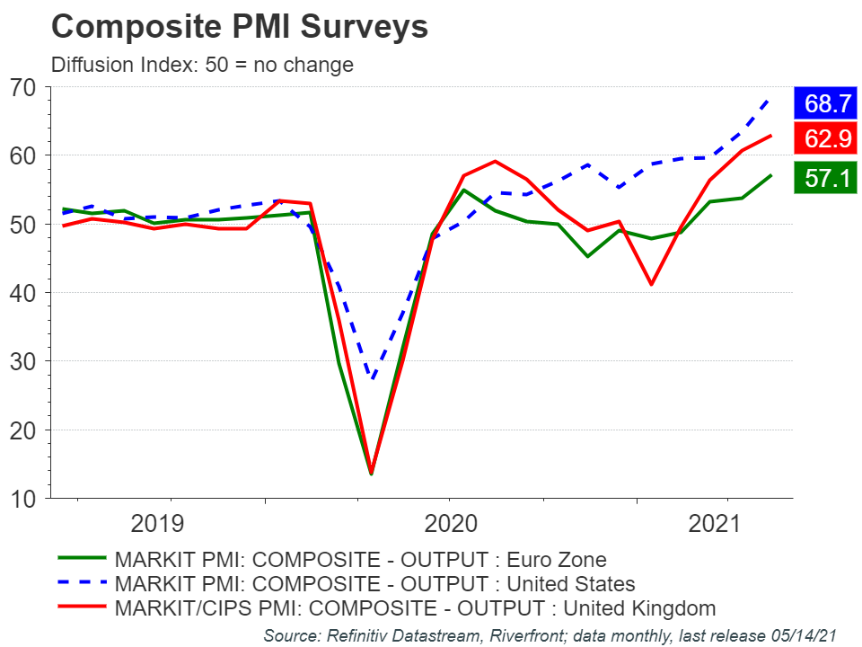

While the US Composite (combining manufacturing and services) Purchasing Manager Index (PMI) survey remains stronger in absolute terms, we are encouraged by the recent strong increases in the UK and most Eurozone countries.

- The Eurozone Composite PMI has firmly entered expansionary territory and was at 57.1 as of the most recent data on May 14, 2021. PMIs in the region are benefitting from the economy reopening and the services’ sectors of Italy, Spain, France, and Germany expanding to support the manufacturing sector, which was not impacted to the same degree as services during the pandemic.

State of European stimulus and lending: Still accommodative, though not as much as the US

- Similar to the US Federal Reserve, Europe’s central banks are flooding their financial systems with capital to ease financial conditions. A recent Bloomberg survey concerning the upcoming ECB meeting highlighted expectations for them to extend its program of faster bond buying throughout the summer. In the UK, however, the Bank of England is already starting to talk of tapering their stimulus program in response to improving economic conditions.

- M3 (one way to measure aggregate money supply in an economy) in the Eurozone appears to have peaked in January 2021 at 12.6% year over year and is now growing at 9.2% year over year. This is meaningfully lower than the US, growing around 18% but also slowing. Like most developed economies, money supply should drop as pandemic stimulus fades, which could help contain inflation as fewer dollars will be chasing assets.

- European private bank loan growth has decelerated from around 4.7% year over year in March to 2.6%, which is still relatively high for the last 5 years, ex-2020. The number of European countries with negative yielding 10-year debt has declined from nine at the start of the year down to three (Germany, Netherlands, and Switzerland). This development is a big positive, in our opinion, for European banks that are trying to return to profitability.

Earnings Momentum: Europe starting to improve, though US is still stronger

-

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

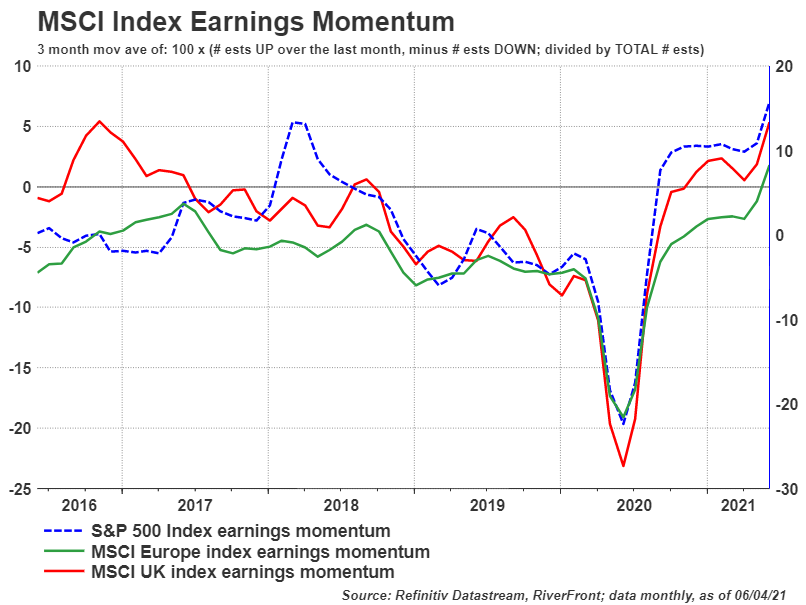

We track ‘earnings momentum’ – a calculation designed to measure the aggregate direction of company analyst estimate revisions. We believe this indicator directionally over time exhibits some positive correlation with stock market movement.

- Both the US and the UK have consistently exhibited powerfully positive earnings revisions since mid-2020, and in fact have both experienced another move up after Q1 earnings season completed.

- Europe is exhibiting a similarly positive pattern, though in absolute terms it is less positive than the US.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI Europe Index — represents the performance of large and mid-cap equities across 15 developed countries in Europe.

The MSCI United Kingdom Index is designed to measure the performance of the large and mid cap segments of the UK market. With 86 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the UK.

The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors. The Diffusion Index, used in technical analysis, a diffusion index measures the number of stocks that have advanced in price or are showing positive momentum. The value of securities may decline as a result of various catastrophic events, such as pandemics, natural disasters, and terrorism. Losses resulting from these catastrophic events can be substantial and could have a material adverse effect on RiverFront’s business and client portfolios.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1676436