U.S. Federal Reserve (Fed) policy will continue to play a large role in both fixed income and equity market performance in 2024 and may be one of the most important factors for investors this year.

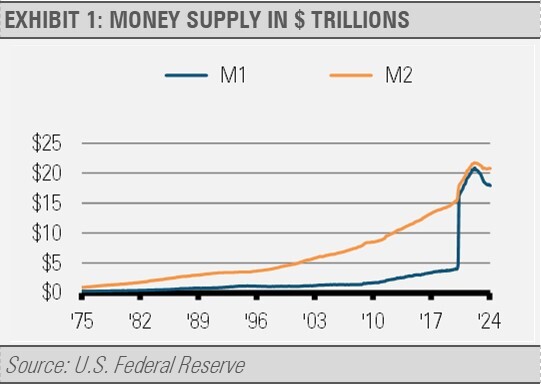

Though inflation continues to run ahead of the Feds target rate, this should subside as the remaining COVID stimulus makes its way out of the system. M2 (Money Supply) has already started to show a declining trend and we would expect this to lead to inflation numbers closer to the Fed’s long-term target of 2% at some point.

For bond investors, all the uncertainty surrounding the timing and degree of Fed rate cuts creates a challenging landscape for the remainder of 2024 and beyond. Active management of fixed income allocations can help mitigate risks and add value in these types of environments.

There are a few data points that we can track that have a big impact on inflation, which is generally the result of too much money. This has kept inflation at the forefront despite a normalization on the supply side of the economy since COVID disruptions. The money supply as measured by M1 and M2 is one input of the inflation picture as M1 consists of cash in circulation and cash equivalents while M2 adds savings accounts and money market mutual funds.

After the large amount of COVID-19 stimulus was pumped into the system, we saw both measures hit their highest levels on record and nearly double their 20-year growth average.

We can now see these series trend downward. This decline may indicate a turning point that should lead to easing inflationary pressures. As the remaining COVID stimulus cycles out of the system, we could very well see these numbers continue to decline and result in further easing an important piece of the inflation puzzle.

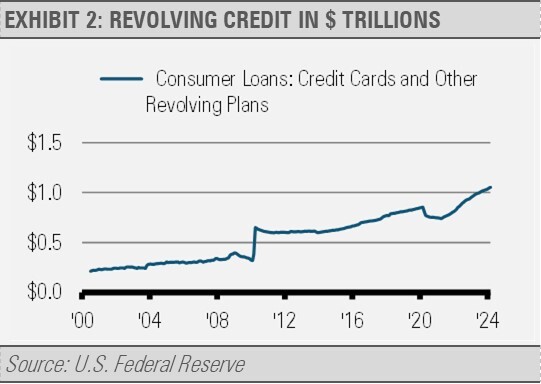

Another important part of the puzzle has been credit. Consumers entered the COVID era in good shape as lessons learned from the Great Recession led to tighter lending standards and more consumer constraint as they struggled to rebuild wealth. More recently, we have experienced an uptick in consumer credit fueled by spending even as prices rose as a result of inflation.

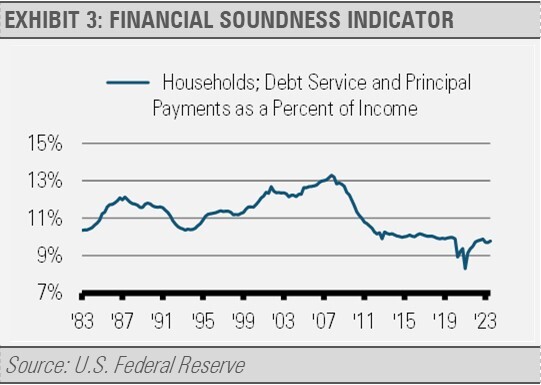

In aggregate, consumers are in good shape with the vast majority of outstanding fixed rate mortgages locked in at low levels along with substantially lower headline inflation and persistent real wage growth. In fact, looking at debt service levels relative to income, we can see that household finances in aggregate are in good shape relative to historical norms.

Consumer strength has been a bright spot, but we will watch closely for changes as Fed policy begins to shift. A lot of clarity will be seen in the coming months as many factors come into play.

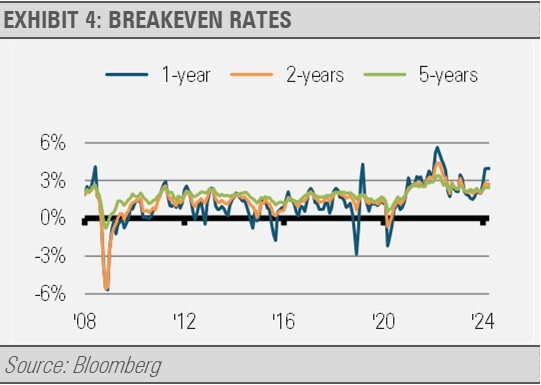

One indication of the market’s expectations for inflation is the TIPs breakeven spread, which measures the difference between the yields on nominal treasuries and treasury inflation protected bonds. Looking at this suggests the market expects inflation to run above the Fed’s target for some time, which could mean we see rates higher for longer than initially expected despite the decline in the level of money in the economy. With inflation already down from near 9%, the decline to closer to 2% will likely not be smooth.

We believe active fixed income management is crucial to navigating policy transition cycles such as these.

With all the uncertainty in the data, there are a several strategies we are using to help mitigate the risk factors and position our bond allocations to take advantage of opportunities as we see the inflation picture play out.

Taking a diversified positioning across the yield curve and credit risk spectrum can provide protection in this environment. While setting a portfolio duration is one part of active management, the contribution to the duration is more integral in this type of environment.

One of components of our strategy has been to incorporate a balance of credit risk and Treasuries. Having bonds that offer a yield advantage and make sense from a credit risk standpoint can help drive performance in what we believe could be a static bond market or worse if the Fed has to deviate from the dot plot. This has led to a balance of credit and Treasuries across the curve.

Short-term Treasury bills coupled with low duration commercial real estate backed bonds provide a yield advantage as shorter rates continue to lead longer maturity yields in the inverted yield curve environment. This duration bucket’s yield is further enhanced with well vetted actively managed credit exposure.

Our intermediate allocation has exposure to Treasuries and credit risk as well. In this bucket we have added target maturity ETFs that can lock more of the current higher yields. Using a bullet or target maturity strategy in an environment of falling short term rates allows an investor to lock in a higher rate for a well-defined period of time as everything in the portfolio matures in a given year. Comparing that to an intermediate term broad market ETF where investors will see their yield deteriorate as maturing bonds on the short end fall off and are replaced with lower yielding bonds, which reduces the overall yield. Bulleted strategies can eliminate much of the fluctuation in yield.

On the longer end, our allocation consists of taxable municipal bonds which in our opinion offer a hybrid of both credit and government exposure and provide a nice yield advantage which will lead to better performance if longer rates move higher from here.

As 2024 unfolds there will be a lot of uncertainty from the Fed, elections, and geopolitical risks. The economy is the other big question. Will we experience a soft landing? Active management in the fixed income space can help mitigate risks through well thought strategies that help diversify risk exposures.

For more news, information, and analysis, visit the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.