Most advisors, and even investors, agree that addressing behavioral finance is necessary for better long-term investing. With all the behavioral finance advice published, why do advisors struggle to successfully execute the advice in their practice?

Despite the many articles published, behavioral finance advice tends to clash with the industry status quo. This creates three major challenges for advisors who want to meaningfully incorporate behavioral finance into their practice.

Problem 1: Investors Don’t See the Value in Behavioral Coaching.

Behavioral coaching, one of the main applications of behavioral finance concepts, is vitally important to any advisor-client relationship. In recent research from Vanguard’s Adviser Alpha[1], behavioral coaching was considered the most valuable component of financial advice, yet investors have a hard time seeing the value of it.

A recent study from Morningstar[2] listed 15 attributes of financial advisors asking investors and advisors to rank them from most important to least important. Investors ranked behavioral coaching dead last while ranking “maximizing returns” in the top five.

While investors found “helping me reach my goals” to be the top priority, they see maximizing returns as the best way to get there. This is at odds with the fact that helping investors stick to a financial plan may add at least 150 basis points of portfolio performance[3]—especially when minimizing losses is more important to the success of a financial plan than maximizing returns. So why this disconnect? If helping investors stick to their plans and avoiding large losses is better in the long-term, why is behavioral coaching valued so little?

First, many think they don’t need coaching. No client wants to hear their advisors tell them “You make stupid mistakes” or “You’re your own worst enemy.” Overcoming this initial bias can be difficult.

Second, it’s harder to measure the immediate value of behavioral coaching. The need for immediate gratification overpowers the abstract future reward. When a bias does factor into a request or decision, the emotional impulse is stronger than logical reflection and action. Does defining what anchoring means or pointing to a client’s herding bias really prevent them from selling low or buying high? Not really.

Third, the burden is fully on the shoulders of the advisor with little support from the industry or investment products. Advisors are expected to manage their clients’ emotions in an environment that works against advisors who seek to implement behavioral coaching.

Problem 2: The Industry Encourages Biased Investor Behavior.

A direct challenge to behavioral coaching and minimizing biased investment decisions is the way the industry over-emphasizes returns and benchmark performance. The financial industry often contradicts itself: The industry preaches that investors should emphasize the long-term, yet the investing landscape has evolved to focus upon short-term distractions.

The industry reinforces this short-term investor mindset and focus:

- A 24-hour news cycle

- Social media information overload

- Short-term monthly metrics

- Daily account access

- Stress on gains rather than goals

- Research ratings focus on gains and fees

This exacerbates behavioral biases and has trained investors to focus on beating the market, chasing the next best investment, and keeping up with the Joneses.

The “meet or beat” the market mantra reinforces the fixation on returns instead of goals.

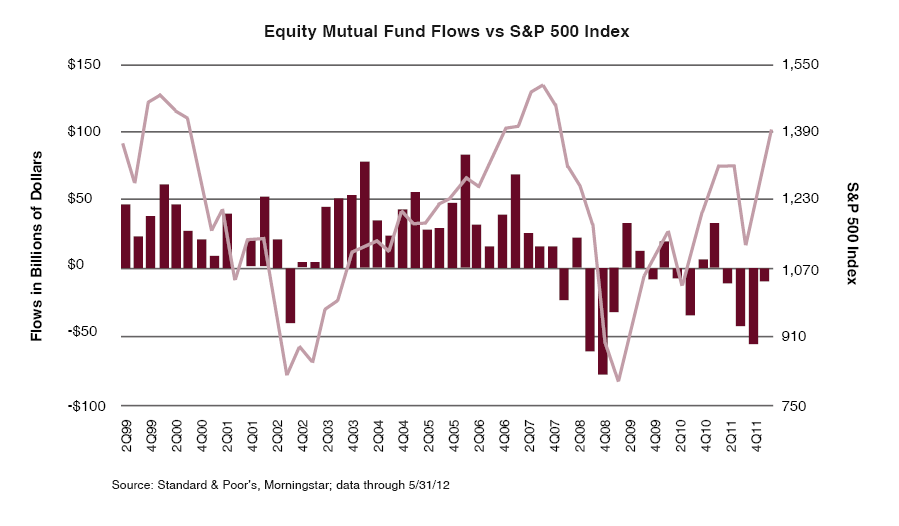

As a result, investors evaluate their advisors based on investment or portfolio performance and recent performance. Investors overvalue short-term performance and devalue the guidance a financial advisor can provide, making it easier for investors to sell in a panic, buy high, abandon financial plans, or ignore experienced advice.

When returns are the measure of value, advisors have a hard time demonstrating their long-term value in many abstract areas like behavioral coaching.

Problem 3: Loss Aversion Is Not Truly Being Addressed at the Portfolio Level.

The biggest challenge to the broader success in addressing behavioral finance challenges is that the products and strategies implemented by advisors, investors, and the industry fail to address the most important emotional driver in investment decisions: fear of losing money, known as loss aversion.

A Cerulli[4] study found that investors really care most about two things:

- They don’t want to lose money.

- They don’t want to run out of money.

People feel the pain of loss twice as much as the pleasure from an equal gain5. Loss aversion has serious implications for investment decisions and is an important behavioral bias that advisors need to emphasize in their practice. Behavioral coaching is tricky enough in up markets, but all that educating and intermittent behavioral coaching flies out the window in big down markets, when it matters most.

Investors often don’t stick to their long-term plans. Advisors will meet with clients, develop a plan that both agree to, the plan looks logical on paper, but when a crisis produces volatile markets, clients deviate from the logical plan in a moment of panic. When markets misbehave, investors follow suit.

The traditional 60/40 and asset allocation haven’t kept investors from giving into their loss aversion bias and going to cash during tough markets.

It’s easy for investors to stick to a plan and coach when things are going great. It’s much tougher during life-altering market drawdowns. Will telling clients to stay calm and stay invested ease their emotions when their accounts are going down 30% or 40%? Probably not.

With the future of bonds looking bleak, depending on them for capital preservation or income may not be a prudent strategy going forward.

Investors generally crave a smooth and calm investment experience. Building portfolios and investment products that seek to provide a calmer experience by managing risk to achieve a goal, rather than chasing gains, need to be at the core of portfolio construction.

How to Redefine Your Practice with Behavioral Finance

Behavioral finance advice usually focuses on defining biases and making the case for including these lessons into advisory practice. Actionable steps and advice are lacking or often too superficial to make any lasting impact.

Advisors are burdened. The responsibility is fully on their shoulders to reeducate, refocus, and redirect investors’ understandings and expectations of financial advice. For advisors, incorporating a successful behavioral coaching approach into their practice is much harder without the support and encouragement of the industry or traditional portfolio strategies.

If the industry is truly focused on goals-based investing and helping investors see the true value of behavioral coaching, it is necessary to redefine the way it looks at returns, planning, and advice.

Swan Global Investments is a participant in the ETF Strategist Channel.