Ongoing market volatility, uncertainty regarding inflation, and rate hikes keep many investors camped in short duration or cash. Investors looking to broaden their short-duration exposures should look to municipal bonds for the tax benefits they offer.

Municipal bonds hold long-term appeal with investors due to their tax status. Interest earned on municipal bonds is not subject to federal income tax. In some instances, municipal bonds are also free of state and local taxes. However, this depends on where an investor lives, where they purchase municipal bonds and state and local tax laws.

The recently launched Eaton Vance Short Duration Municipal Income ETF (EVSM) offers diversified exposure to the municipal bonds market. By focusing on a duration of less than three years, it offers the potential of a reduced rate risk profile over longer duration peers.

See also: “Morgan Stanley Converts 2 Mutual Funds Into Active ETFs“

EVSM invests between 80% and 100% of its assets in municipal bonds. When determining which municipal bonds to include, the fund’s managers consider the creditworthiness of the issuer. This includes any ratings information and an investment analysis of the issuer. EVSM may invest up to 20% of its assets in regular taxable income securities and variable and floating rate instruments.

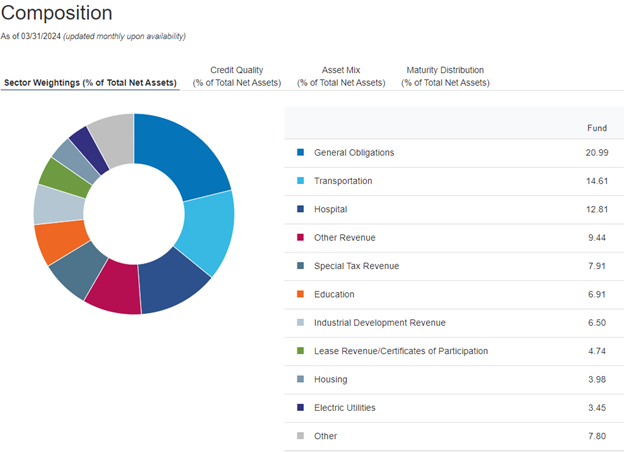

The fund also offers diversified exposure across municipal bond sectors, reducing single-sector risk.

Image source: Eaton Vance

EVSM invests at least 85% of its assets in investment-grade municipal bonds rated BBB or higher. No more than 5% of assets are invested in muni bonds rated B- or lower. The fund’s primary credit quality rated AA (46.4%) and A (37.03%) as of 03/31/2024.

Municipal bonds are susceptible to interest rate rises. However, EVSM’s active management proves valuable in a changing rate narrative. The fund also benefits from its shorter duration exposure should rates rise. When rates eventually decline, municipal bonds at high rates have the potential to appreciate in value.

EVSN currently has a yield to maturity of 3.99% as of 04/15/2024 and a 0.19% expense ratio.

For more news, information, and analysis visit The ETF Yield Channel.