Spikes in copper prices in mid-March led to a surge in long copper positions this month. Bullish copper investors would do well to look beyond the metal to miners who stand to benefit from surging investment.

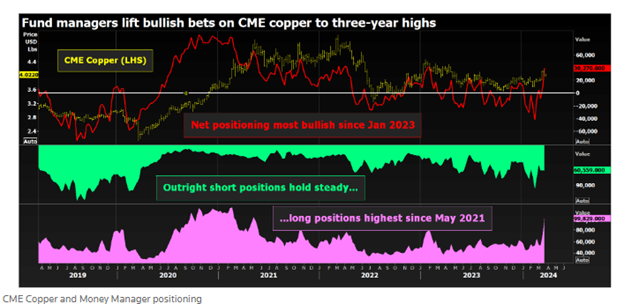

Copper prices mostly moved sideways in the last year, with many investors choosing to sit on the sidelines. Fresh highs for copper prices the week of March 18 triggered massive buy-ins to long positions.

London Metal Exchange copper prices exceeded their year-long trading range on March 18 to touch an 11-month high of $9,164.50 per metric ton. In response, long positions in CME copper contracts rose 43% the week of the 18th, Reuters reported.

Image source: Reuters

It’s the most bullish copper investors on the CME have been in a year. On the LME, copper investors are positioned the most bullish since the exchange began releasing its Commitments of Traders Report in 2018.

Prices surged this month on news that Chinese smelters agreed to cut back on production due to supply constraints. Ongoing supply shortages create a potentially constructive outlook for copper prices. It’s also a metal that plays a critical role in renewable energies, with forecasts for exponential demand increases in the coming years.

Copper Miners Benefit from Bullish Investing

Copper miners are positioned to benefit from increasing investment due to exponential demand growth. The Sprott Copper Miners ETF (COPP) seeks to track the Nasdaq Sprott Copper Miners Index. The Index includes global companies within the copper industry, namely developers, explorers, and copper producers.

The fund invests in miners positioned to benefit from the exponential growth in demand for copper in the coming years. These same companies also benefit from increased copper investment as the energy transition picks up speed. COPP carries an expense ratio of 0.65%.

Investors with a higher risk tolerance seeking growth opportunities within copper miners should consider the Sprott Junior Copper Miners ETF (COPJ). COPJ is a one-of-a-kind fund that offers targeted exposure to small copper miners. The fund seeks to track the Nasdaq Sprott Junior Copper Miners Index. The Index includes small, mid, and micro-cap copper miners or companies related to copper mining.

Junior miners carry the potential for strong growth and revenue opportunities for investors. Given growing copper demand forecasts in the coming years driven by electrification, upstream companies within the copper supply chain will likely benefit from an influx of investment. COPJ carries an expense ratio of 0.75%.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.