With substantial attention being paid to growth and value stocks this year, defensive sectors such as utilities are flying under the radar. However, the sleepy sector offers some opportunity through the Biden Administration’s infrastructure plan.

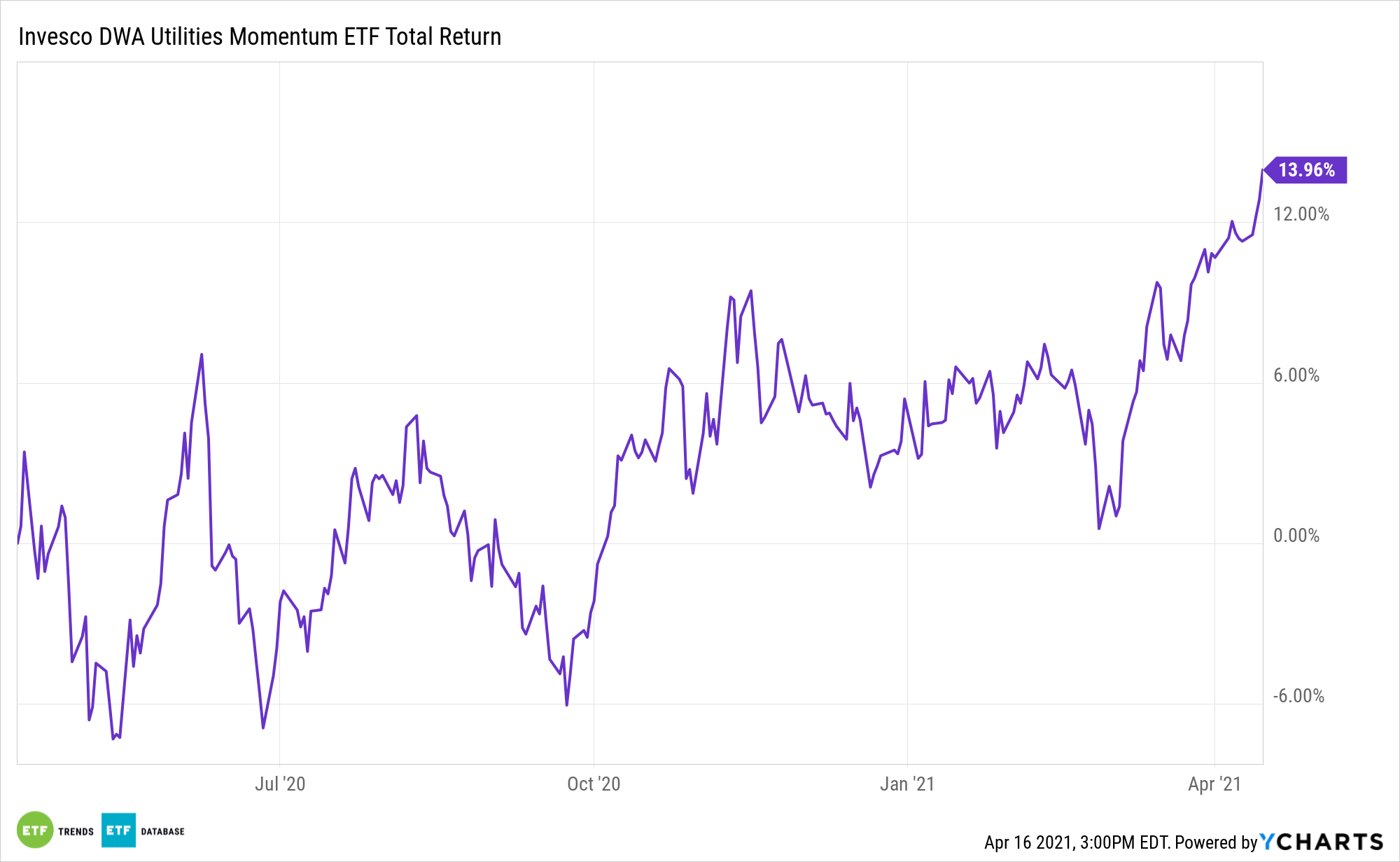

That could be a catalyst for exchange traded funds such as the Invesco DWA Utilities Momentum Portfolio (NASDAQ: PUI), which is one of the more unique offerings in this category.

PUI tracks the DWA Utilities Technical Leaders Index. That index “is designed to identify companies that are showing relative strength (momentum), and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe,” according to Invesco.

Flexibility is key to the fortunes of PUI components in what’s expected to be a new order of power generation.

“The U.S. power industry would comply with a proposed requirement that it eliminate carbon emissions by 2035, but it must be allowed flexibility on how to achieve the goal and the ability to miss compliance deadlines that prove unrealistic, says the Edison Electric Institute lobby group,” per Seeking Alpha.

Why Utilities?

Utilities are typically more stable stocks since the demand for their services, notably electricity and gas, is steady from both consumers and businesses. Moreover, in a lower-for-longer yield environment, utilities come with more attractive, above-average dividends.

“The industry is concerned that President Biden’s goal to quickly eliminate its emissions will require breakthroughs in clean energy technology that currently do not exist, such as long-duration battery storage for wind and solar power, advanced nuclear plants, and carbon capture projects,” adds Seeking Alpha.

Adding to the allure of PUI is the utilities sector’s increasing footprint in the fast-growing renewable energy arena.

“Utilities will be leading investors in renewable energy and supporting infrastructure like transmission and smart grids,” writes Morningstar. “The U.S. is set to add nearly 50 gigawatts of solar and wind generation capacity in 2021-23 based on planned or under-construction projects. That would bring U.S. solar and wind capacity nearly equal to coal generation capacity.”

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.