In the last two years, investors increased their cash positions in the face of ongoing volatility and risk. While sitting on the sidelines reduces risk, it also means missed return opportunities. High-quality short-term bonds offer several portfolio benefits while putting excess cash to work.

Short-duration exposures and cash alternatives received notable investor flows last year as interest rates and yields rose. Much is uncertain about the intermediate rate narrative. For advisors and investors considering increasing their short-term bond allocations as interest rate concerns spike, there are a few considerations to weigh.

Short-Term Bonds Benefit Whichever Way Rates Go

Shorter duration bonds offer attractive yields while the yield curve remains inverted. Should the Fed raise rates further this year, these bonds stand to benefit similar to the previous 18 months. If rates hold steady at higher for longer, short duration provides flexibility and the ability to pivot quickly.

For investors worried about the impact of a falling rate environment on short-term bonds, there’s good news.

“Over recent Fed rate-cutting cycles, the total return from short-term government/credit strategies has materially outperformed their money market counterparts due to price appreciation and yield spread capture,” explained Tyler Williams, VP, ETF capital markets and product at Natixis Investment Managers in a recent paper.

Short Duration Doesn’t Always Mean Low Risk

In the last two years, short-term bonds have become exponentially popular with investors. An inverted yield curve and rising rates have resulted in most investors trimming long-duration bond exposures and adding more short-term bonds. However, investors still need to consider risk in their shorter exposures.

Many investors seek short-term bonds to hedge against broader portfolio volatility. In an increasingly competitive market for short-duration bond strategies, issuers seek to capture investor attention with lower fees or higher yields.

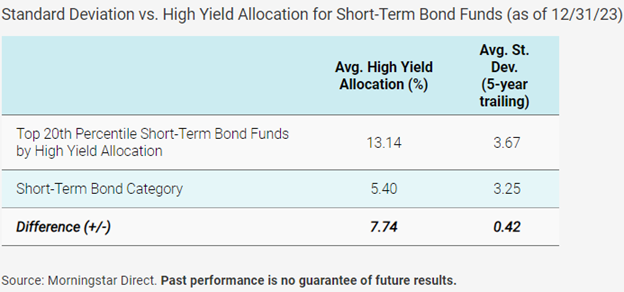

“Some short-term strategies focus on providing a higher relative yield than competitors and will bulk up on riskier, lower-rated securities to do so,” Williams said.

Image source: Natixis

Just as in other assets, higher yield generally equates to greater risk and volatility in short-term bonds. Understanding what’s under the hood and driving a strategy’s yields proves enormously beneficial in times of heightened volatility and market risk.

When Looking to Yields, Also Mind the Duration

How a short-term bond strategy generates its yields isn’t the only thing investors need to be mindful of. More than half (61%) of fund selectors reported using short-duration ETFs to reduce duration risk in the 2024 Natixis Global Fund Selector Outlook Survey. Understanding a short-term bond strategy’s actual duration exposure matters.

See also: “Fund Selectors Weigh In: 2024 Portfolio Construction”

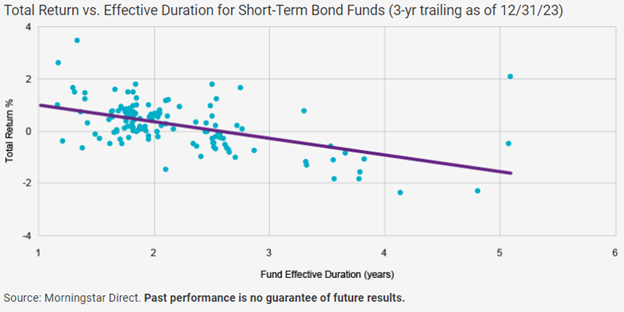

Some short-duration strategies invest further out on the yield curve when chasing total returns or yields. Should interest rates rise, investors may experience greater drawdowns in their short-duration exposures than anticipated.

“For example, a short-term bond ETF with a 2-year duration will see a price decline of about -2% if interest rates rise by 1%,” explained Williams. Meanwhile, “a strategy that extends the duration to 4 years will see that price decline double to roughly -4% in the same scenario.”

Image source: Natixis

Active management continues to prove attractive in ongoing volatility and an elevated rate risk environment. In the same survey, 75% of fund selectors believe active strategies will yield alpha opportunities this year.

If you are looking for income opportunities within short-term bonds, the Natixis Loomis Sayles Short Duration Income ETF (LSST) is worth consideration. The fund is actively managed and utilizes both top-down macro analysis and bottom-up security selection. It seeks to offer a balanced risk and reward profile against its benchmark, the Bloomberg US Government/Credit 1-3 Year Bond Index.

LSST’s strategy diversifies across sectors, including securitized debt and below-investment-grade bonds. The management team measures the risk of such investments against the income and return potential when investing.

The fund’s effective duration was 1.82 years, and as of 03/31/2024, its 30-day SEC yield was 5.07%. LSST has an expense ratio of 0.35%.

For more news, information, and analysis, visit the Portfolio Construction Channel.