Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and Nick Peters-Golden debate whether alternatives, commonly referred to as alts, deserve portfolio allocation in 2024.

Karrie Gordon, staff writer, VettaFi: Hey Nick, I look forward to discussing alternatives with you today. It’s an arena of investing I find particularly fascinating and where a lot of innovation is happening on the ETF side. While I’m a firm believer that alts deserve a permanent place in portfolios, this year, in particular, warrants intentional inclusion of alts strategies.

Nick Peters-Golden, staff writer, VettaFi: Hi Karrie, likewise! I like alts as much as the next person, but there’s a time and place for anything. Right now, I think the place to be is finding innovation in the 60/40. We’ll see what the readers think!

Diversification Still Matters in 2024

Gordon: Alts gained significant attention in the last few years as stock and bond correlations rose, and for good reason! Correlations are the enemy of the 60/40 portfolio. When stocks and bonds move in tandem, the historic equity hedge that bonds provide collapses.

Enter alternatives with their diversified return streams. Alt strategies are enormously varied but exhibit a level of fundamentals that differ from stocks and bonds. A great example of this is if we look at the most talked about alt this year, bitcoin.

Cryptocurrency prices are impacted by the macro environment and risk-on and risk-off sentiment. However, they also respond to the strong fundamentals of the underlying technology, crypto’s widespread adoption and regulatory changes, among other factors. What’s more, the ability of spot bitcoin investors to earn capital by staking their bitcoin provides a further level of non-correlated returns. You need look no further than bitcoin with its prices up more than 50% YTD on regulatory approval of spot bitcoin ETFs.

The same goes for gold this year, options-based strategies and the premiums they rely on, hedge fund strategies, commodities, and more. They all demonstrate diversified return potential. With much still uncertain about inflation and when the Fed will begin cutting rates, diversifying beyond stocks and bonds just makes sense.

Peters-Golden: I respect the argument for alts, absolutely. Prudent investing involves some degree of diversification, but not when there’s an obvious way to get diversification with solid returns. Investors don’t necessarily need an alts allocation when they can get strong equities exposures diversified away from the S&P 500 if that’s the goal – and it may not be necessary in the first place.

Let’s say investors do want diversification away from the standard U.S. stock market. Perusing VettaFi’s list of global ex-U.S. ETFs, for example, we can see some real standouts. The Invesco S&P International Developed Momentum ETF (IDMO) has returned 38% over one year, per VettaFi data. Charging just 25 bps and tracking the S&P Momentum Developed ex U.S. & South Korea LargeMidCap Index, more than half of its allocation invests in Japan.

Over the three-year, one-year, and YTD periods, IDMO has outperformed the S&P 500 (SPX) without leaning on any U.S. exposures. It charges more than SPY does, sure, but per the chart below, investors would have gotten better performance out of IDMO. It does that and provides returns at a significant distance from the U.S. economy overall.

IDMO has outperformed SPX.

Of course, past performance doesn’t guarantee future results. However, comparing IDMO to an alternatives allocation, one can combine returns with diversification away from the U.S. to some degree.

This all presumes that investors are looking for diversification for safety in case the U.S. economy implodes. What if, however, the U.S. economy is really resilient right now instead?

If one wants alternatives for their performance but is less dedicated to diversification for safety’s sake, it may make sense to just stick to the U.S. economy. Much has been written about whether the Fed could stick a soft landing after rapid rate hikes, but broadly, the economy looks set to pull off the landing. To me, that limits the need for other sources of returns.

Another Great Year for Options Overlay Strategies

Gordon: Whichever way the Fed and economy go, you can’t deny the popularity and power of options overlay strategies. These strategies rose to prominence in 2022 when stock and bond correlations resulted in significant pain for traditional 60/40 portfolios. In the ongoing inflation and rate uncertainty of 2023, these funds flourished, continuing to draw in significant flows.

Ongoing growth for options strategy ETFs will likely continue this year according to Nicholas Elward, senior VP, head of institutional product development and ETFs at Natixis Investment Managers. In fact, options overlay ETF growth is one of Natixis’ top three ETF investment themes this year.

Many of these strategies seek enhanced income within core exposures. Options income ETFs utilize premiums earned from writing calls as an add-on to underlying exposures. As such, they’ve proven an attractive, diversified income stream to existing fixed income holdings.

Natixis launched the Natixis Gateway Quality Income ETF (GQI) last December. GQI currently generates a 7.79% 30-day SEC yield as of 03/25/24. The JPMorgan Equity Premium Income Fund (JEPI) is another popular options income ETF, up nearly $1.4 billion in flows YTD. The NEOS S&P 500 High Income ETF (SPYI) recently crossed $1 billion in AUM with distribution yields of 12.14% as of 02/29/24.

Other options strategies hedge against equity risk and drawdowns. Still others seek to mitigate volatility. However, the inflation and rates narrative evolves this year, and options overlay strategies offer a number of benefits to income portfolios and deserve inclusion.

Peters-Golden: One part of investing that investors should always keep in mind is opportunity cost. Whatever investments are made in one area is money that can’t be invested elsewhere. That opportunity cost can really come back to haunt you, and with rate cuts coming down the chain from the Fed, the potential pain could be severe for investors who miss out on a rate cut boost.

What are the chances of such a turn of events? Certain economic areas like renewables, tech, and even styles like fundamental investing could benefit from cheaper debt.

Renewables, for example, already had some strong structural factors in its favor. Clean energy investing has already benefited from significant government funding, but as a space, renewables tech leans on taking out lots of debt. The pieces are there and if the debt can be had for lower rates after cuts, the category could stand out.

A similar outlook applies for disruptive tech. A.I. has boosted the entire economy, helping leading tech names like Nvidia (NVDA). However, leaning on those big names in A.I. can make the economy top-heavy. Instead, looking for the “next” disruptive tech names to grow significantly could appeal. Rate cuts could help debt-intensive, disruptive tech names significantly towards the back end of 2024 and the start of 2025.

Finally, outside of specific areas, rate cuts could also help kickstart the broader U.S. economy. Reigniting home sales, for example, via dropping mortgage rates could help spending elsewhere. Lower interest rates overall could help consumers spend more, boosting the overall economy, too. Big names, growth, and value alike could benefit from stronger underlying data as more money flows into the economy.

Meanwhile, alternatives may be less likely to benefit from rate cuts. Many alts strategies use options or buffers limit their ceilings in exchange for a higher floor, or for income. What’s more, certain alts strategies avoid the broader economy in exchange for exposure to illiquid assets, instead. Given the potential upside in rate cuts, creating artificial limits via alts could produce serious opportunity costs.

Alts Benefit in 2024

Gordon: I agree on ensuring portfolio construction accounts for rate cuts this year. However, many alternatives stand to benefit, and investors would be remiss not to consider them.

Gold is probably one of the most well-known alternatives for investors. Long sought after for its perception as a safe haven, gold prices continue to break records this year. Historically, falling rates and a weakening U.S. dollar drive investors to seek gold as a hedge against equity risk. It makes the yellow metal particularly attractive this year, given the forecast for interest rate cuts.

Gold futures prices set ongoing record highs this month just on news of the Fed’s ongoing commitment to rate cuts later this year. When those rate cuts actually begin, gold could benefit further. The SPDR Gold Shares (GLD) is up 5.42% on a price return basis YTD as of 03/26/24. REITs, long under pressure from elevated rates, also benefit in a falling rate environment.

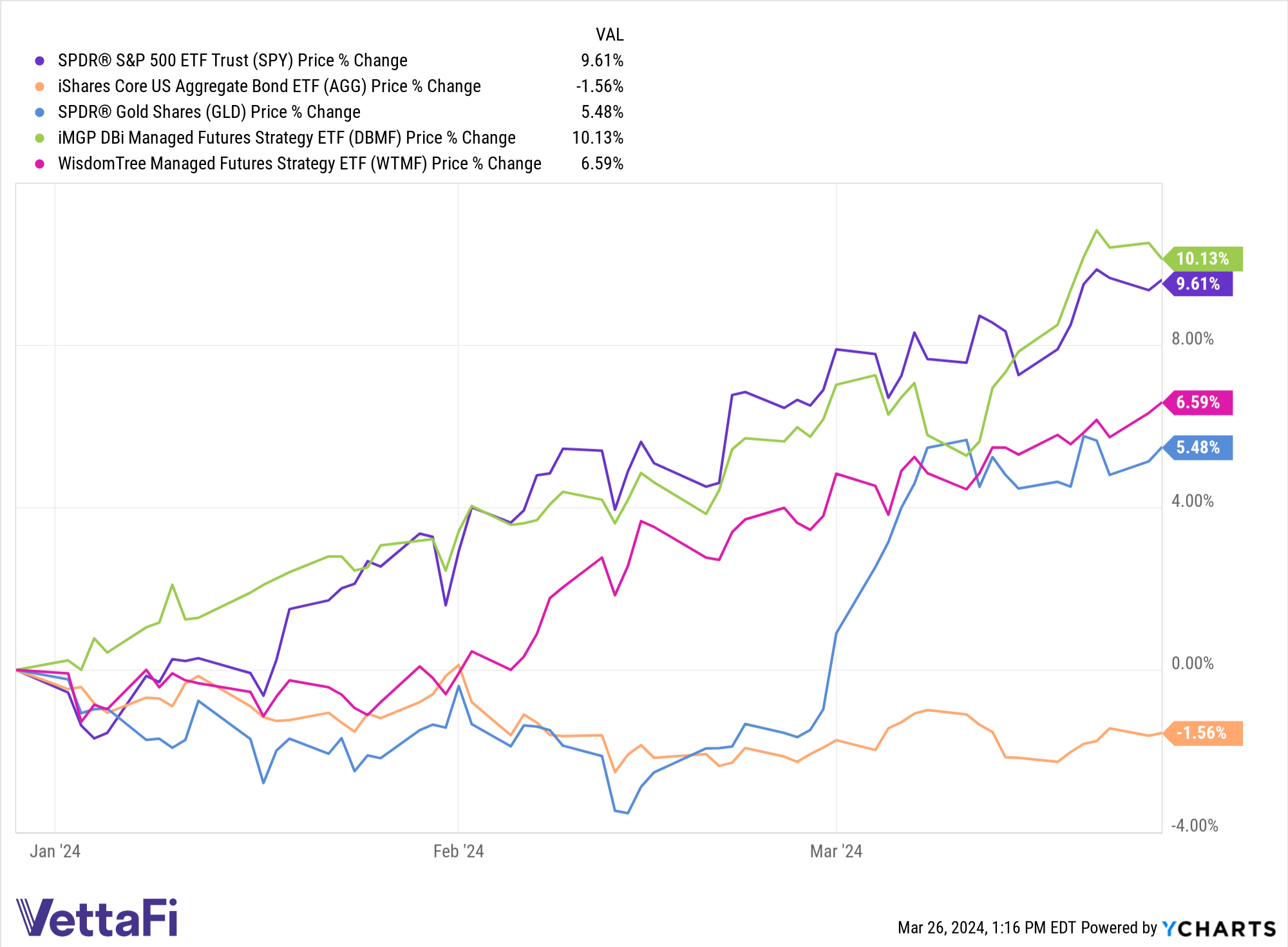

If, instead, you’re looking to ongoing volatility or market dislocations, look no further than managed futures ETFs this year. These strategies invest in the futures market, thereby offering low to sometimes negative correlations to stocks and bonds. They seek to invest in how asset classes actually trade instead of relying on forward-looking estimates or outlooks.

Managed futures ETFs provide strong diversification and offer noteworthy returns YTD. The iMGP DBi Managed Futures Strategy ETF (DBMF) is up 10.36% on a price return basis YTD. Meanwhile, the WisdomTree Managed Futures Strategy Fund (WTMF) is up 6.59% YTD.

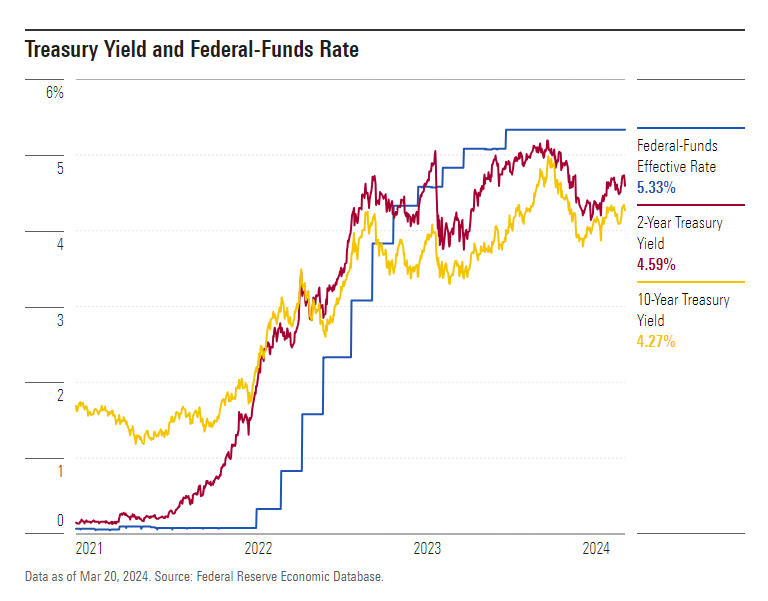

Peters-Golden: I’ve done a lot of talking about equities solutions compared to alts, but I’d be remiss not to mention fixed income here. Alts discourse hit a fever pitch prior to the rapid interest rate hikes by the Fed, in part because the 40 in the 60/40 portfolio wasn’t doing its part. Now, with bonds offering yields that haven’t been seen in quite a while, fixed income can play the role alts are angling for.

Yes, fixed income’s yields aren’t where they were in the Fall. However, strong yields are still very much available. Consider this graph from Morningstar:

Fixed income yields data from Morningstar.

Clearly, there are places to put assets within the wide world of bonds. Fixed income can stand out vs. alts, especially for investors closer to retirement for whom a more traditional investment may appeal. The maturity of the bond space, too, stands out. While the alts ecosystem is relatively new, bond investing has, of course, been around for generations.

So, where are the bond areas that really appeal right now? You could do well with broad bond exposures, sure, but clearly investors are flocking to corporate bonds. A record amount of money has arrived into corporates as investors rush to lock in high yields. Both investment-grade and junk debt from corporations are seeing inflows.

Part of that owes to the above expectation of rate cuts and a soft landing. In that case, even high yield could appeal. The Franklin High Yield Corporate ETF (FLHY) has done really well over the last few years with its active approach. Charging 40 bps, it has returned 13.4% over the last 12 months and 4.8% over the last five years (annualized). Both numbers have helped it outperform both its ETF Database Category and Factset Segment averages.

For more news, information, and analysis, visit the Portfolio Construction Channel.