Investors have a lot on their plates right now. The Fed looks set to lock in a new paradigm in which the well-anticipated rate cuts become much less likely to arrive this year. Combine that higher for longer regime with a potential tech and AI bubble, and risks abound in equities portfolios. That’s where a midcap allocation can play a key role.

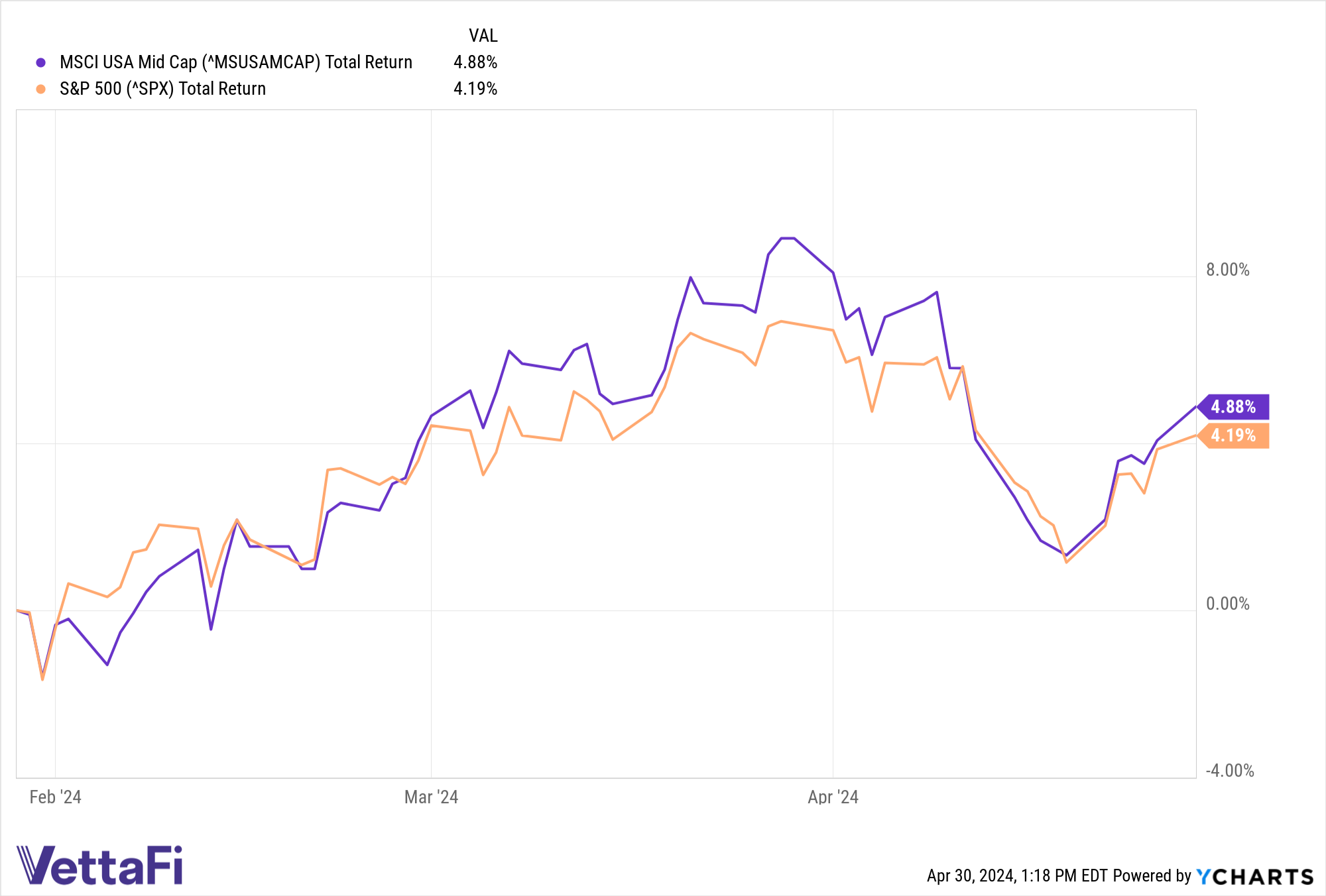

Midcap stocks combine growth potential with financial stability. They avoid the financial instability of small-cap stocks, with more room to grow than large caps have. The midcap index MSCI USA Mid Cap Index has outperformed the S&P 500 over three months, per YCharts. The former index has returned 4.9% compared to the S&P 500’s 4.2%.

A midcap allocation could present one way to outperform major market indices.

As of the start of this year, the S&P 400 MidCap beat the returns of the S&P 500 in half of the last 32 calendar years, according to the Wall Street Journal.

See more: VNMC Outperforms Within Midcaps

A midcap allocation, then, can provide a healthy alternative to an S&P 500 allocation alone. At the same time, with small caps missing out on anticipated rate cuts, midcaps can provide greater maturity and, in some cases, better balance sheets upon which to build a growth allocation.

The Natixis Vaughan Nelson Mid Cap ETF (VNMC) may then appeal as a route into a midcap allocation. VNMC charges 85 basis points (bps) for an active approach. The ETF looks for midcap firms with lower price-to-book ratios. To make those assessments, it considers attributes like business fundamentals and discounted cash flow models.

That has helped VNMC return 22.4% over one year and 7.5% YTD, according to Natixis Investment Managers data. As a midcap allocation, it may attract investors looking for an active strategy with a fundamental view of the space.

For more news, information, and analysis, visit the Portfolio Construction Channel.