Inflation and interest rate hikes have not been kind to REITs and the funds that own them. However, their low valuations could indicate an opportunity for investors.

Most property indexes are down around 3% on an annualized basis for the past three years through April 19, including a 9%-10% loss for this year alone. That compares unfavorably to the 7.73% and 2.27% annualized gains of the S&P 500 and the Vanguard Balanced Index fund (VBAIX), respectively, for the same time frame. About the only thing REITs have beaten is bonds, which have turned in a 3.47% annualized loss for the three-year period.

And that performance comparison indicates something about what happened to the asset class prior to the rise of inflation and rates. The lack of bond yield for most of the past 15 years, and especially in 2021, caused the $157 billion asset class to take in a torrent of assets. In 2021, funds in the category gained $18 billion in flows, including $6 billion in the behemoth $65 billion Vanguard Real Estate ETF (VNQ). The ETF was down nearly 10% year to date on April 19.

REITs Offered High Yields When Bonds Didn’t

REITs are structured so that they pay out 90% of their net income as dividends in exchange for tax-free status at the corporate level, making them a prime equity substitute for bonds that were yielding nearly nothing.

But with the bad performance, $4 billion has left the funds in the category over the past year through March 2024, and $9 billion has left over the past two years.

Of course, certain property types are experiencing idiosyncratic problems. Post-COVID office vacancy rates are painfully high, and retail’s longer-standing struggles with competition from Amazon persist (though logistics/warehouse landlords’ benefits from online shopping somewhat offset physical mall struggles).

But the chase for yield represented by massive 2021 inflows was undeniable. The irony — now that all that money has fled over the past two years — is that the asset class looks reasonably priced on at least one key metric.

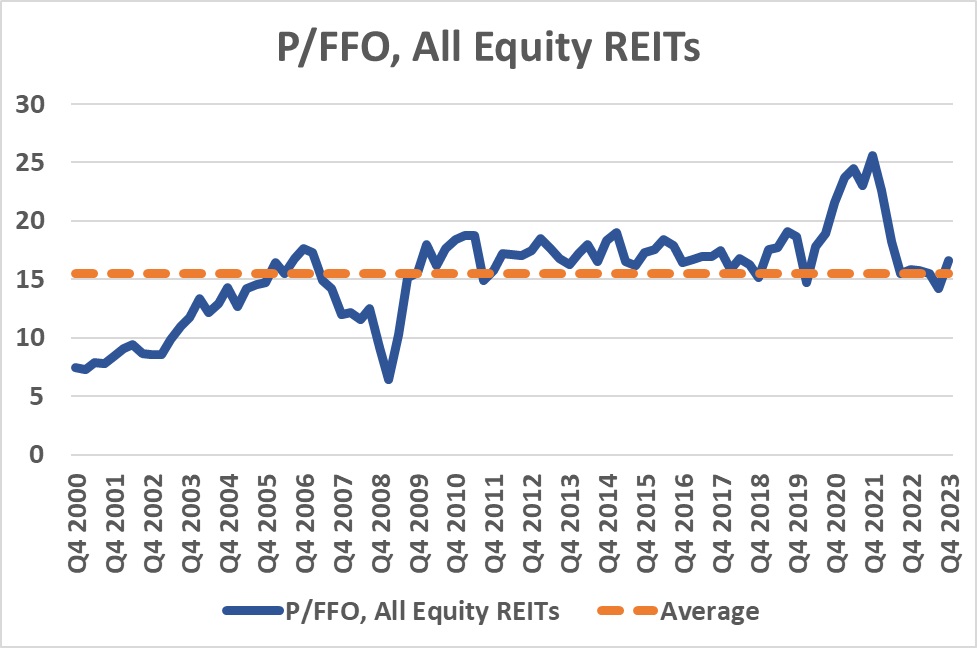

The National Association of Real Estate Investment Trusts (NAREIT) posts Price/FFO for the sector quarterly, and it shows significant overvaluation in 2021, when it reached 25, and a return to the longer-term average of 15-16 at the end of 2023. (FFO is funds from operations, a REIT cash flow metric that adjusts net income for depreciation and property sales, allowing investors to ascertain how much cash flow existing properties are delivering.)

Cheap From a Valuation Perspective

Research Affiliates in Newport Beach, California corroborates the simple P/FFO charts with its analysis. The firm that manages smart beta and valuation-based asset allocation strategies sees “a 7% nominal [annualized return for REITs]over the next decade,” according to Jim Masturzo, the firm’s CIO of multi-asset strategies.

“A lot of that return is coming from a healthy starting dividend yield of 4%. You won’t find that in too many other places,” he added. “From a valuation perspective, we think they’re slightly cheap.”

Masturzo also said active management could be in order when seeking exposure to the category: “We don’t say that a lot at Research Affiliates.”

What he meant is there are “still a lot of headwinds in office … work from home is up, and we read about office buildings selling cheaply every day.” There are also opportunities there, Masturzo noted.

“[You] have to do extra digging for where the gems are in the basket. That being said, if you’re looking to hold for a decade, there’s nothing wrong with holding the basket,” he explained

Office space is no longer the significant part of the index it used to be, after all. Boston Properties, the largest public office REIT, is the thirty-eighth position of VNQ, occupying 0.61% of the fund.

Inflation Isn’t Over

Regarding inflation, Masturzo said,”‘nobody really wanted to talk about it from mid-last year through January. Now everyone wants to talk about it. Our inflation expectation is 2.7% [annualized]for the next decade — not crazy or huge — [but]inflation historically comes in waves, as we saw in the 1940s and 1970s.”

In choosing between those two historic scenarios, Masturzo thinks the 1940s example fits better: “I like the ‘40s example – double-digit [inflation]in 1948, then deflation, then [it]spiked back up to double-digits again.”

In other words, we could well have another inflation peak or aftershock, and “from that perspective, owning real assets is always going to be a benefit,” he added.

Masturzo cautioned that REITs will have volatility; they are equities after all. Research Affiliates put its expected standard deviation of returns at around 20% for the next decade. But “if you’re okay with that short-term volatility, having access to the real asset is the best inflation fighter you’ll find,” he said.

Getting more granular, Masturzo argued that apartments are benefiting from high home prices. The “rent-vs.-buy models say renting is more affordable, but that’s allowed apartment owners to increase rents.”

Even the problems with offices may start to improve. “Now that we’re starting to experience long-term effects [of working from home], the limits of video conferencing. . . . there’s some pushback on some of those things,” Masturzo said.

For more news, information, and analysis, visit Vettafi | ETF Trends.