The electric vehicle market is just getting started when it comes to sales and growth. The runway is long for EV investors, given EV market forecasts of $56.7 trillion by 2050. It’s a great time to gain exposure to the growth potential through funds like the KraneShares Electric Vehicles and Future Mobility ETF (KARS).

EV sales grew 61% in 2022 to 10.4 million units worldwide according to KraneShares data. Expectations for EV sales this year are around 14 million units. While it’s slower growth than between 2021 to 2022, it’s still substantial growth in a challenging macro environment. This also puts the total number of EVs on the road somewhere in the vicinity of 40 million globally by year’s end.

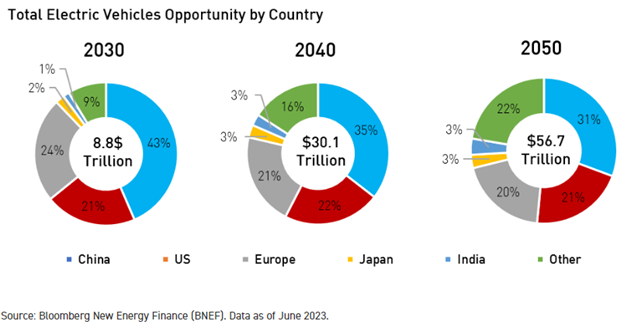

Image source: KraneShares

BloombergNEF calculated EV market growth to $8.8 trillion by 2030, ballooning to $56.7 trillion by 2050. Passenger EVs will make up the bulk of sales over that period, accounting for 80% of the market share in 2030 and 70% by 2050.

The outlook for electric vehicles continues to grow despite global economic challenges.

“Despite macroeconomic challenges, electric vehicles continue to be a rare source of growth for global investors,” wrote Anthony Sassine, CFA, senior investment strategies and head of MENA at KraneShares, in a recent analysis.

Recent earnings wins from major EV manufacturers globally despite price cuts underscore the momentum in the space. “This illustrates the potential diversification benefits obtained from investing in electric vehicles as growth tends to be more driven by energy transition tailwinds than economic cycles,” Sassine wrote.

See also: “Electric Vehicle Investment Thesis is Revving Up”

Capture the Full Potential in the EV Market With KARS

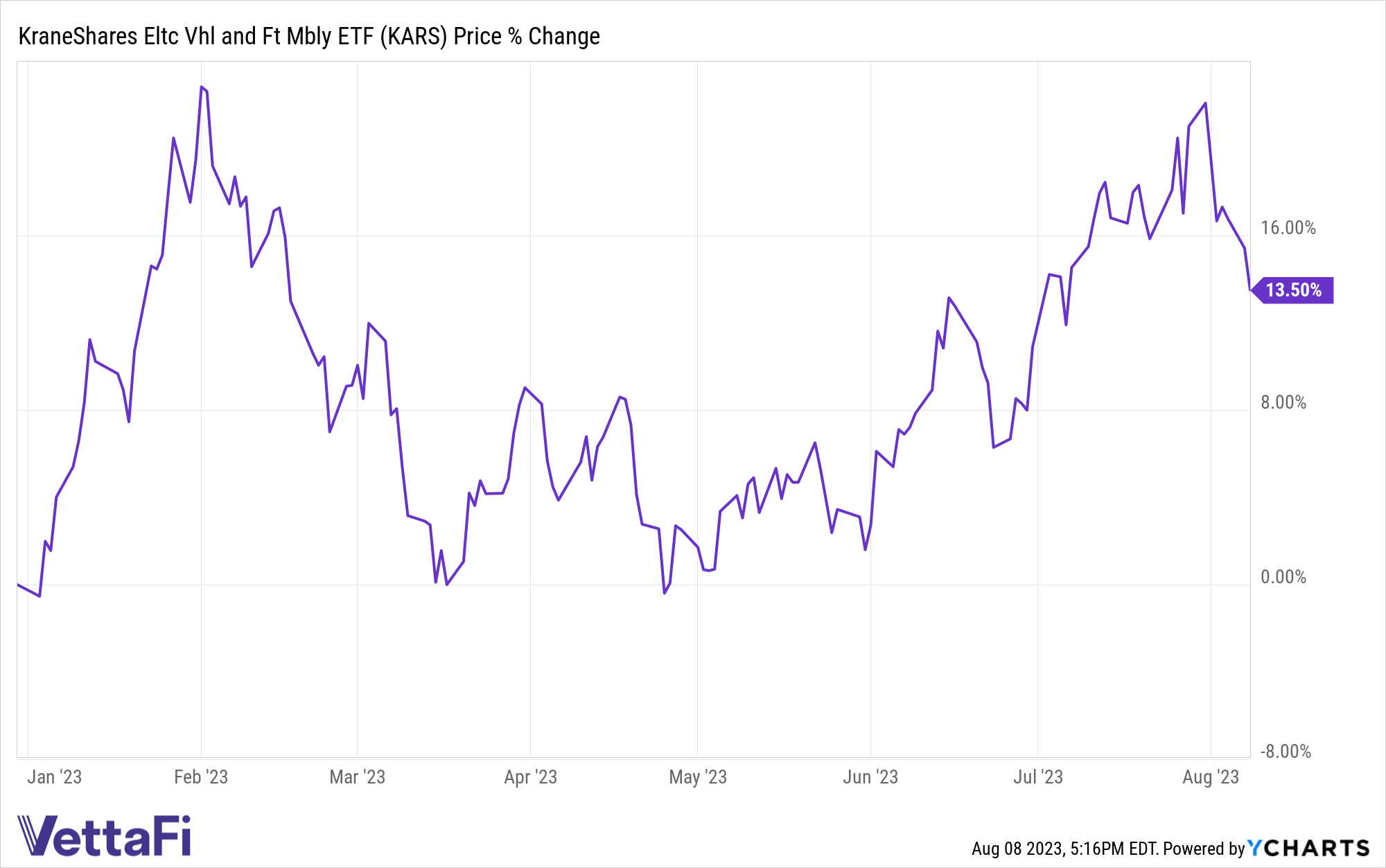

With momentum continuing to build for EVs, investors would do well to consider funds that invest along the breadth of the EV market to capture the full potential. The KraneShares Electric Vehicles and Future Mobility ETF (KARS) takes not just a global approach to EV exposure, but also invests along the entirety of the value chain.

KARS measures the performance of the Bloomberg Electric Vehicles Index, which tracks the industry holistically. This includes exposure to electric vehicle manufacturers, electric vehicle components, and batteries. It also includes hydrogen fuel cells and the raw materials utilized in the synthesis of producing parts for EVs.

KARS invests in many familiar car companies such as Tesla, Ford, and Mercedes-Benz, and major Chinese EV manufacturers such as Li Auto, Nio, and BYD. It also goes a step beyond and invests in the companies that contribute to the EV value chain. These include Samsung, Panasonic, and Albemarle, a major lithium manufacturer.

KARS carries an expense ratio of 0.70%.

For more news, information, and analysis, visit the Climate Insights Channel.