April was a relatively quiet month for ETFs across the board. U.S. equity inflows took a breather. Still, flows across the pond have proceeded apace, as more investors seek out opportunities abroad.

International equity ETFs have enjoyed a steady stream of monthly inflows all year long. They have netted more than $30 billion in 2024. The Vanguard Total International Stock ETF (VXUS) and the iShares Core MSCI EAFE ETF (IEFA) topped the charts – both taking in $4 billion in new money and both rallying about 5%.

But emerging markets aren’t getting left behind. Third on the list is the iShares MSCI Emerging Markets ex-China ETF (EMXC), which has also amassed roughly $4 billion in inflows and has risen 5% this year on a total return basis.

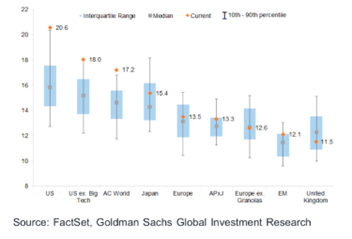

Investors are increasingly looking to diversify away from U.S. stocks, which continue to hover around record highs and trade at historically rich multiples. Instead, many are turning to deeply discounted markets with lesser-known companies and undervalued prospects – especially with Treasury rates now apt to stay higher for longer.

Global Market Multiples (Forward P/E)

Two bright spots, in particular – Japan and India – are dominating inflows into country-specific ETFs.

Japan: Entering a New Era

The Japanese stock market notched historic highs for the first time since 1989. The nation is exiting a decades-long deflationary spiral and entering a new era of inflation. Japan’s rally has been bolstered by a weaker yen, strong foreign investment, and expectations that the Bank of Japan will hold firm on its accommodative monetary policy course.

Globally, investors have had very underweighted exposure to Japan. The recent rally has sparked renewed interest in Japan-focused ETFs. These ETFs have pulled in more than $10 billion since January 2023.

The two largest Japan-based ETFs – the WisdomTree Japan Hedged Equity Fund (DXJ) and the iShares MSCI Japan ETF (EWJ) – have both seen north of $1 billion in net inflows this year with returns of 25% and 9%, respectively. DXJ hedges out currency risk, stripping out the impact of the yen and offering more “pureplay” exposure to Japanese stocks. It holds 446 securities – more than twice the number of EWJ – and charges a comparable 0.48% expense ratio.

Two of the cheapest alternatives out there have also pulled in strong flows. The J.P. Morgan BetaBuilders Japan ETF (BBJP) offers broadly similar large- and mid-cap exposure to the EWJ but charges 0.19%. The Franklin FTSE Japan ETF (FLJP) takes a much broader approach with more than 500 holdings while charging a mere 0.09%.

The Nikkei turned in a stellar 2023, surging more than 28%, and continues to edge out the S&P 500 this year.

India: Bulls on Parade

India is riding its longest and best-ever bull market. The Nifty 50 index is pacing for a possible ninth-straight year of gains. It’s now on track to remain the world’s fastest-growing major economy in 2024. Strong government spending and a friendlier business environment are also boosting sentiment. The nation is making strides toward a more industrialized future.

Buying into India’s stock market is no simple feat for U.S.-based investors. Still, a handful of ETFs have allowed them to try to capture the Nifty 50’s stellar returns.

The largest India ETF, the iShares MSCI India ETF (INDA), hit an all-time intraday high last week and have risen nearly 30% over the past year. The fund, which charges 0.65%, holds more than 100 securities with large-cap concentration and has seen $1.2 billion in net inflows. Investors willing to take on more volatility risk and fill in the gaps with more small-cap exposure have bought into the iShares MSCI India Small Cap ETF (SMIN) – which has pulled in $270 million.

Similarly, the WisdomTree India Earnings Fund (EPI), which tracks a broader earnings-weighted, rather than market cap-weighted, index, has also risen nearly 40% over the past year and seen more than $800 million in new money.

A lower-cost option exists in Franklin FTSE India ETF (FLIN), which charges just 0.19% – making it the cheapest product of its kind but also far smaller and less liquid than its peers.

Tensions between the U.S. and China are simmering. Foreign firms wanting to decrease their dependence on China are redeploying assets out of China and into the world’s fifth-largest economy. India’s economy has also been buoyed by a burgeoning middle class – echoing China’s economic landscape in recent decades.

Monitoring capital flows into global equities promises to be intriguing. The world faces asynchronous global growth trends. In addition, it is navigating through ongoing geopolitical conflicts and a record number of elections this year.

For more news, information, and analysis, visit VettaFi | ETF Trends.