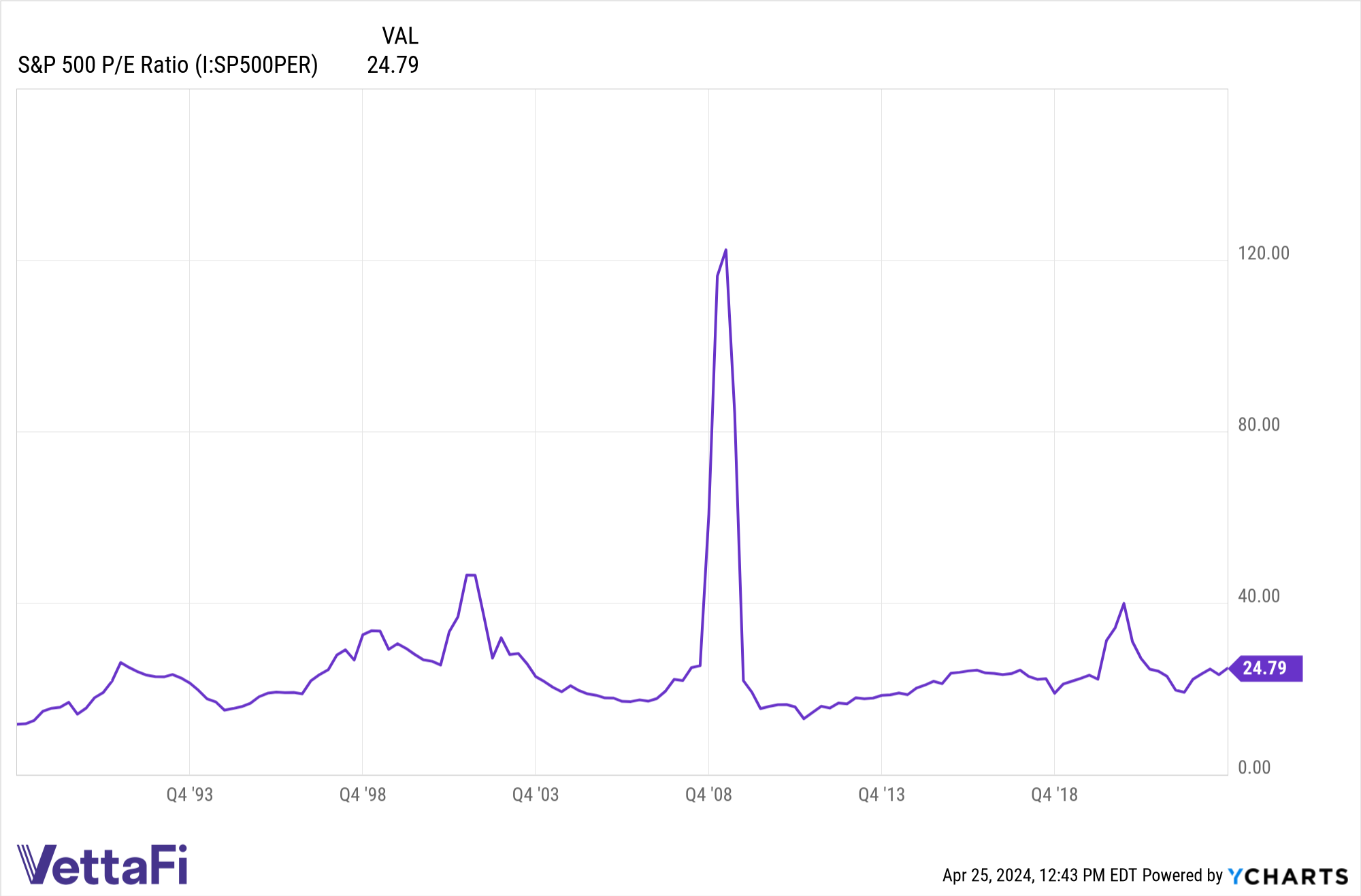

Is the stock market expensive? It’s an idea that gets tossed around a lot, but investors don’t always get the chance to dig in and look closer. Looking back at the S&P 500’s price-to-earnings (PE) ratio, the current value of 24.8 sits a bit higher than the historical values prior to 2020, per YCharts. In such an environment, with some real risks floating around this year, investors may want to consider a growth-at-a-reasonable price ETF, or GARP ETF.

The stock market’s historical P/e ratio as measured by the S&P 500 P/e ratio.

See more: The Merits of Broad Sector Dividend Exposure in SDOG

Why a GARP ETF? A growth-at-a-reasonable-price approach excludes firms with extremely high valuations. The approach combines growth and value characteristics to look for firms that appeal for one reason or another, while screening those that don’t meet certain PE ratio standards.

GARP ETF BFOR

The ALPS Barron’s 400 ETF (BFOR) charges a 65 basis point (bps) fee for its approach, and may appeal to curious investors. The ETF adds in an intriguing wrinkle via its equal weighting of 400 firms selected based on GARP methodology. Excluding REITs, it equal weights those 400 companies that meet that GARP methodology.

The GARP ETF has done well over the last one, three, and five year periods thanks to its approach. Per its manager’s site, BFOR has returned 12.31% over the last five years and 9.4% over the last ten years. Over the last one year period, it has returned 26.2% and on a YTD basis, it has returned 9.1%. Those numbers outperform VettaFi’s ETF Database Category average over all of their respective time periods.

BFOR’s approach has crafted a relatively diversified set of holdings, with soldi small, mid, and large cap representation. 2024 is offering its own risks even as the stock market is expensive. Should rate cuts fail to materialize or an AI bubble pop, many larger players may take hits to their valuations. A GARP ETF like BFOR that looks for firms already sporting appealing valuations, then, may intrigue investors as one way to plan ahead.

For more news, information, and strategy, visit the ETF Building Blocks Channel.