Wednesday’s CPI report had some positive news for markets as overall inflation continued to drop, but with underlying price pressures still keeping core CPI hotter than the Fed wants, “higher for longer” rates are very much in the cards. Core prices ex-food and energy actually accelerated from 5.5% in February to 5.6% in March. As such, it may be worth adding three current income ETFs to the inflation-fighting shortlist, given how income can be an important boost to long term portfolios.

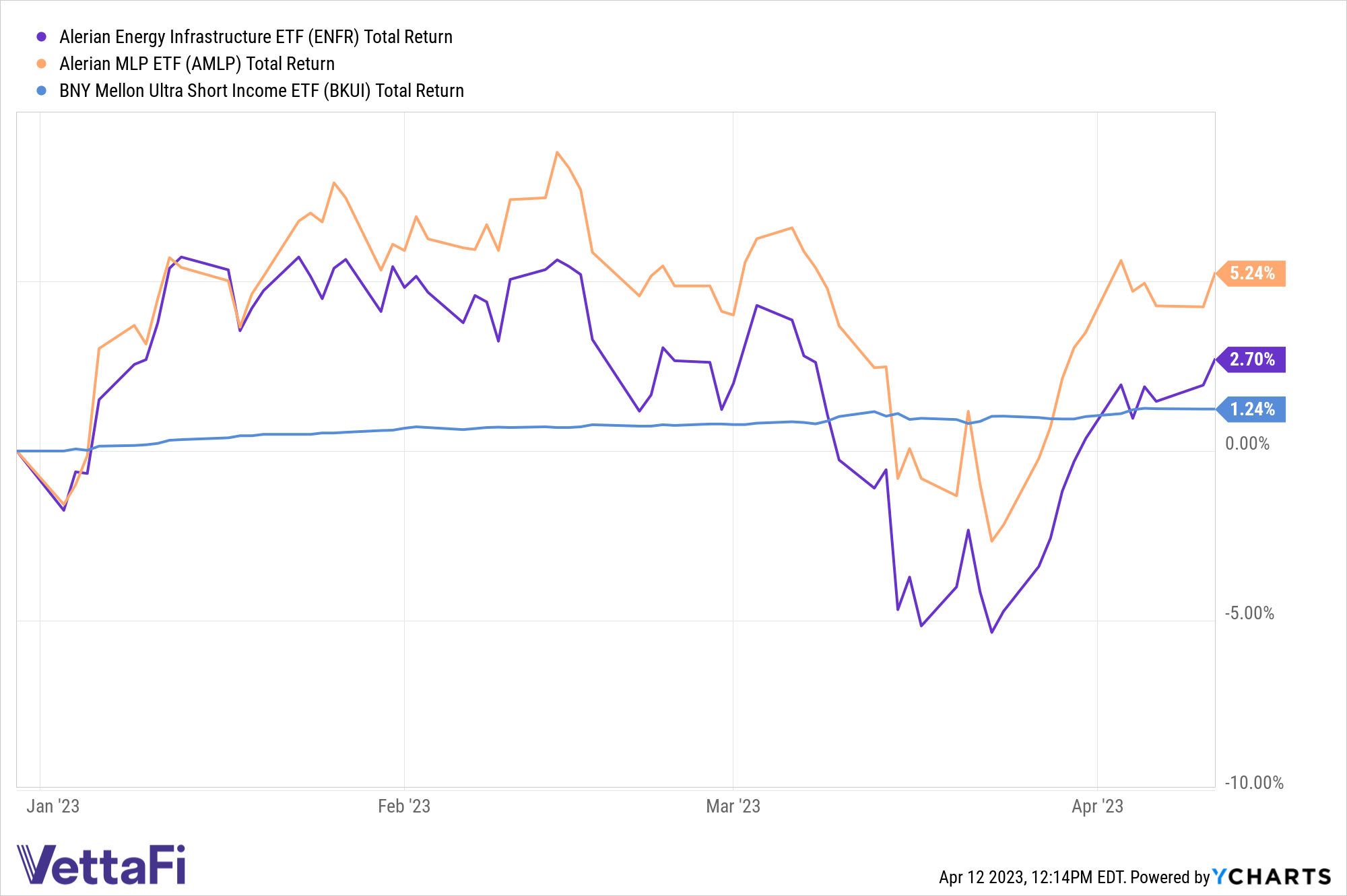

To start, investors should keep the potent yields from the Alerian MLP ETF (AMLP) on their radar. Investing in master limited partnerships (MLPs) that combine publicly-traded liquidity with a private partnership approach to investing, AMLP invests in MLPs that each earn at least 50% of their EBITDA from assets that are not directly exposed to commodities, with a particular lean towards energy infrastructure.

See more: “The Investment Case for the Energy Transition Portfolio”

With quarterly distributions offering steady income and avoiding corporate income taxes at the federal and state level, MLPs avoid a lot of the costs that other income-focused strategies face, while their singular focus on the U.S. also avoids tax challenges facing investors in emerging markets. AMLP has added $76 million in one month net inflows while also offering a 7.84% dividend yield for its 87 basis point (bps) fee.

Turning towards the world of fixed income, the BNY Mellon Ultra Short Income ETF (BKUI) could be worth a look. Many investors and advisors want to up their exposure to fixed income, but it can be tough to find the right debt slice in which to invest. BKUI offers two important factors, low volatility and high income, as part of its aims, and through its active approach, uses a proprietary top-down and bottom-up investment process to identify which US-denominated securities offer the best return.

Investing typically in a basket of investment-grade, USD-denominated fixed income securities like corporate debt, asset-backed securities, and US Treasuries, BKUI charges a relatively low fee for its active approach, asking just 12 bps for its exposures and its 2.6% annual dividend yield.

Finally, given the state of play around energy investing, one would be remiss not to mention the Alerian Energy Infrastructure ETF (ENFR). ENFR tracks an index of energy infrastructure companies in the U.S. and Canada weighted by market cap, and manages to avoid the tax inefficiencies of the C-Corporation and ETN structures — benefits that stand out in tax season.

ENFR charges just 35 bps for its approach, offering a 5.9% dividend yield. Whichever route investors decide to go, both fixed income and MLPs can mitigate tax costs and offer notable dividends, bolstering the case for current income ETFs in a rising rate-focused portfolio.

For more news, information, and analysis, visit the ETF Building Blocks Channel.

vettafi.com is owned by VettaFi, which also owns the index provider for AMLP. VettaFi is not the sponsor of AMLP, but VettaFi’s affiliate receives an index licensing fee from the ETF sponsor.