By Mike Dickson, Ph.D.

Are U.S. consumers ready to go more rounds?

“When will the consumer finally crack?” is a question that seems to be on more investors’ minds these days—not surprisingly, given that consumer spending has been a major driver of the U.S.’s generally robust economic growth. While investors cheer consumers’ continued strength, they’re also nervously looking for any signs that the economy’s biggest engine may be sputtering after what’s been a remarkable run.

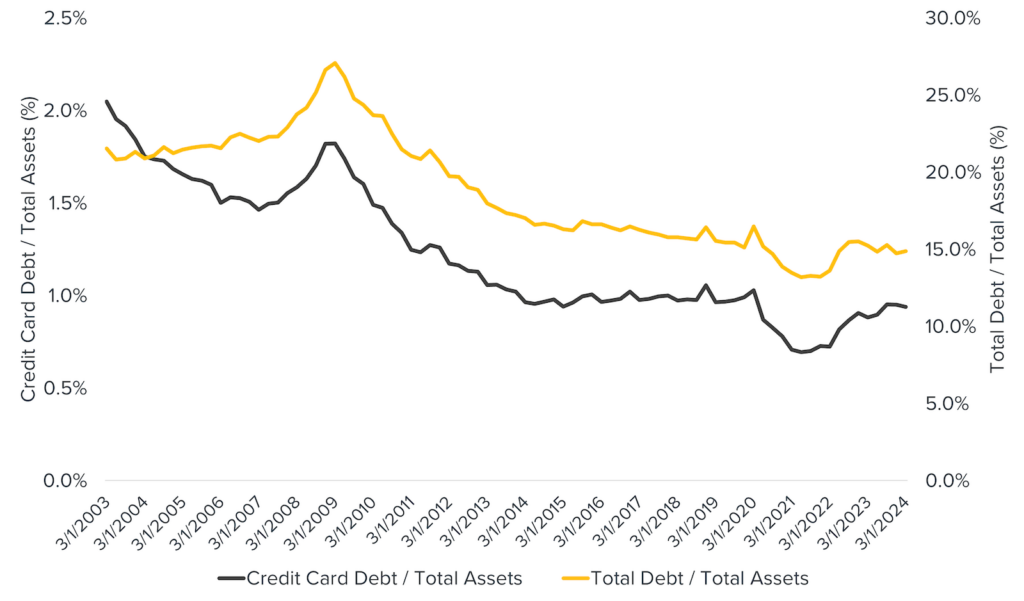

Household Debt as a Percentage of Total Assets

Source: Federal Reserve Bank of New York, calculations by Horizon Investments. As of May 14, 2024

This week, new data from the Federal Reserve Bank of New York confirms that consumers are still in fighting shape. As the chart above shows, despite consumers’ total credit card balances exceeding $1 trillion:

- Credit card debt relative to total assets (the black line and the data on the left side of the chart) at the end of the first quarter was just 0.9%—lower than both its long-term, pre-pandemic average of 1.3% and where it sat at the end of 2023.

- Total household debt compared to total assets (the yellow line and the data on the right side of the chart) was just 14.9% as of March 31st. That’s well below the long-term average of 19.8% and lower than it was at the end of last year.

The upshot: Although total debt has hit record levels, consumers’ ability to service that debt—to comfortably make their principal and interest payments—appears to remain strong and well under control.

Other encouraging news based on the Fed’s latest report:

- Overall delinquency rates across all loan types remain at 1.5 percentage points, below the pre-pandemic level of 2.4%.

- The median credit score of newly originated auto loans was four points higher than last quarter, at 724—the highest on record—while the median credit quality of newly originated mortgage loans remained roughly stable.

- Outstanding student loan debt was roughly unchanged during the quarter.

There are concerning signs that merit watching closely. Aggregate delinquency rates for credit cards increased in the first quarter of 2024, and more borrowers are behind on payments. Even though credit card debt represents only about 6% of total debt, a growing number of delinquencies may suggest weaker consumer spending trends are emerging—particularly given some of the lower-than-expected consumer confidence readings we’ve seen lately.

But overall, we think the message is clear: Now is probably not the time to underestimate the American consumer.

This commentary is written by Horizon Investments’ asset management team. Past performance is not indicative of future results. Nothing contained herein should be construed as an offer to sell or the solicitation of an offer to buy any security. This report does not attempt to examine all the facts and circumstances that may be relevant to any company, industry, or security mentioned herein. We are not soliciting any action based on this document. It is for the general information of clients of Horizon Investments, LLC (“Horizon”). This document does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any analysis, advice, or recommendation in this document, clients should consider whether the security in question is suitable for their particular circumstances and, if necessary, seek professional advice. Investors may realize losses on any investments. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All investing involves the risk of loss.

The investments recommended by Horizon Investments are not guaranteed. There can be economic times when all investments are unfavorable and depreciate in value. Clients may lose money. This commentary is based on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The opinions expressed herein are our opinions as of the date of this document. These opinions may not be reflected in all of our strategies. We do not intend to and will not endeavor to update the information discussed in this document. No part of this document may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without Horizon’s prior written consent. Forward-looking statements cannot be guaranteed. Other disclosure information is available at www.horizoninvestments.com.

Horizon Investments and the Horizon H are registered trademarks of Horizon Investments, LLC

©2024 Horizon Investments, LLC.