The Canadian ETF marketplace is one of innovation and growing investor interest. ETFs now comprise 15% of all publicly available investment assets in Canada according to ETF Market. To get a high-level look at the Canadian ETF market, we’ll review the top ETFs this year through three different lenses, including returns and flows.

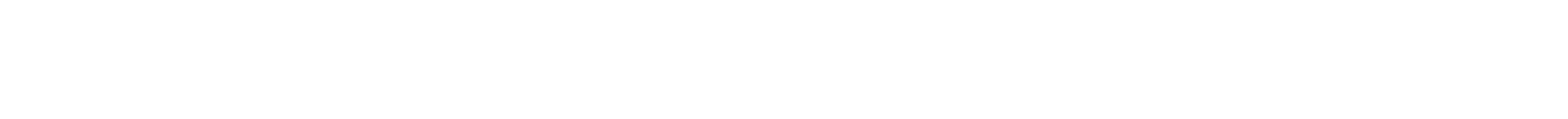

Top 3 Canadian ETFs by Returns in the Last Month

The top three ETFs in Canada on a returns basis in the last month showcase some of the variety of the Canadian market. All data according to LOGICLY, as of September 8, 2023.

- Purpose Marijuana Opportunities Fund ETF (MJJ CA) is an actively managed fund that invests across the cannabis ecosystem globally. The active managers seek countries with a supportive regulatory environment and invest in subindustries that include cultivation, extraction, retail, and financing. The fund also invests in IPOs and private companies.

- Purpose Monthly Income Fund (PIN CA) seeks to generate income by investing in stocks, bonds, and real assets. The fund invests in dividend-paying equities as well as bonds in North America and internationally. Real assets include gold, oil, and gas companies such as Chevron and Exxon, and more. The strategy also utilizes a corporate class structure for tax efficiency.

- BetaPro Inverse Bitcoin ETF (BITI CA) seeks to provide investment results that are up to 1x the inverse daily performance of the Horizons Bitcoin Front Month Rolling Futures Index (Excess Return) over a single day. The index seeks to replicate the returns of a long position in bitcoin futures.

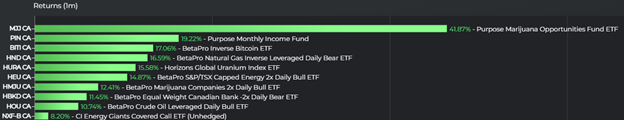

Top 3 Canadian ETFs by Returns YTD

It’s no surprise given tech outperformance this year that the Canadian marketplace mirrors the U.S. one. All three top-performing Canadian ETFs year-to-date are tech-centric ones as of September 8, 2023.

- Amazon (AMZN) Yield Shares Purpose ETF (YAMZ CA) utilizes a covered call strategy (50% coverage) as well as leverage (25%) coverage to generate enhanced yield in Amazon. The fund generates monthly, tax-efficient yields while protecting from currency risk.

- Horizons Big Data & Hardware Index ETF (HBGD CA) seeks to replicate the Solactive Big Data & Hardware index’s performance and net expenses. The index tracks companies within data development, storage, and management-related solutions and services globally. It also tracks hardware-related services and hardware utilized in applications like blockchain.

- Evolve FANGMA Index ETF (CAD Unhedged) (TECH.B CA) invests in just six mega-cap technology companies via an equal-weight strategy. The fund offers concentrated exposure to Meta, Amazon, Netflix, Google, Microsoft, and Apple. It does so by tracking the Solactive FANGMA Equal Weight Index.

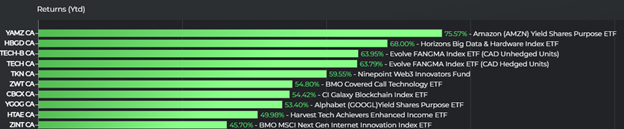

Top 3 Canadian ETFs by Flows YTD

The top three Canadian ETFs by flows brought in a collective $5.5 CAD (approximately $4 billion USD) YTD.

- CI High Interest Savings ETF (CSAV CA) seeks to generate high monthly income while also maintaining both capital and liquidity. The fund invests mainly in high-interest deposit accounts. It seeks to generate higher yields on cash balances while providing short-term investment opportunities. The fund has net flows of $2 billion CAD YTD.

- iShares ESG Aware MSCI Emerging Markets Index ETF (XSEM CA) invests in one of BlackRock’s ESG-focused indexes at BlackRock’s discretion. The index currently chosen for the fund is the MSCI Emerging Markets Extended ESG Focus Index. The index tracks large- and mid-cap companies from emerging markets with positive ESG characteristics. The fund has net flows of $2 billion CAD YTD.

- Horizons High Interest Savings ETF Class A (CASH CA) is another fund that focuses on generating high monthly income while retaining liquidity and capital. The fund invests mainly in high-interest deposit accounts with Canadian banks. It offers monthly distributions and has net flows of $1.4 billion CAD YTD.

For more news, information, and analysis, visit the ETFs in Canada Channel.