For advisors who were tired of the Federal Reserve’s fight against inflation and its impact on the economy, the last week’s bank crisis may be the straw the breaks the camel’s back. Investors of all stripes still want an equity exposure, whether those nearing retirement or clients just starting out. That could set up a quality strategy to be an appealing option for now or the long term in an ETF like the WisdomTree U.S. Quality Growth Fund (QGRW).

Hear from a WisdomTree leader on the firm’s view on dividends here.

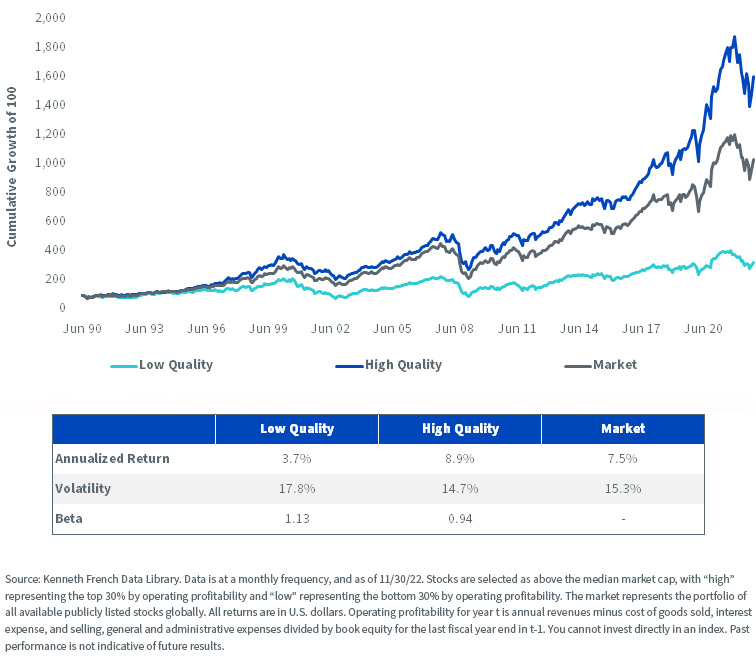

Quality may make sense right now given the volatility markets are seeing, as high-quality stocks tend to outperform the market with less volatility. Factors like defensiveness in crisis and resilient behavior across the behavior cycle could be really useful right now, and when combined with long-term outperformance as the main characteristics that define quality, they could make a powerful strategy for near and longer terms.

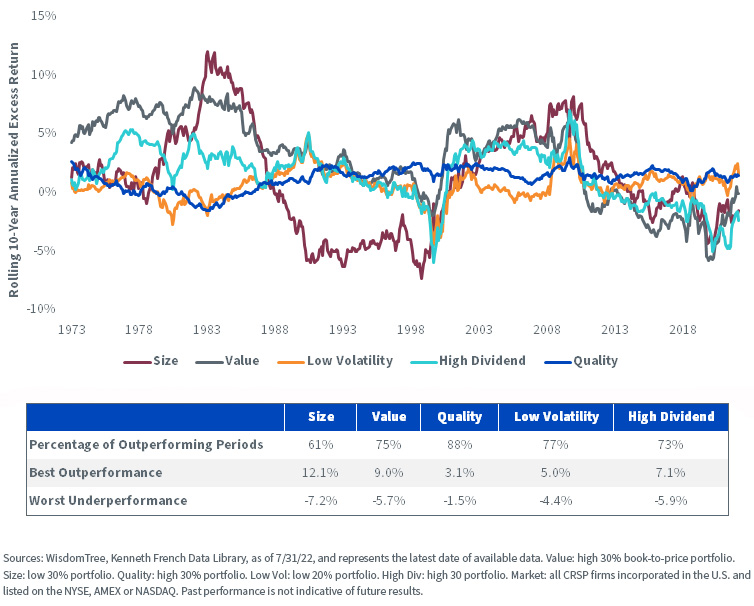

Such characteristics also position a quality investment to perhaps serve as a core allocation, too. Sure, investors could hold your standard, broad-index ETFs that are going to take Federal Reserve, rising rate, or bank crisis pain straight to the face, but by adding quality to a core portfolio, that pain can be notably mitigated. As an investment factor, quality has been steady — steadier, one could argue, than even much-vaunted styles like low volatility or high dividend strategies.

Read more on combining quality with dividends here.

Considering these factors, it might be worth taking a look at an up and coming quality strategy like the WisdomTree U.S. Quality Growth Fund (QGRW). QGRW has not only seen some solid returns YTD, returning 15.5%, but also 5.2% over the last week as all eyes have turned toward the bank crisis. QGRW invests in 100 large-cap growth firms in a market cap-weighted index with the strongest quality characteristics.

Charging 28 basis points, the strategy compares well to its core allocation rivals when considering its factor-based approach. While it is a relatively new strategy that launched back in 2022, its holdings include very liquid names that make the strategy quite liquid on its own, with firms like Visa (V) and Microsoft (MSFT) easy to get into and out of for the strategy. For those investors looking for a quality strategy for near and long terms, QGRW may be one to watch.

For more news, information, and strategy, visit the Modern Alpha Channel.