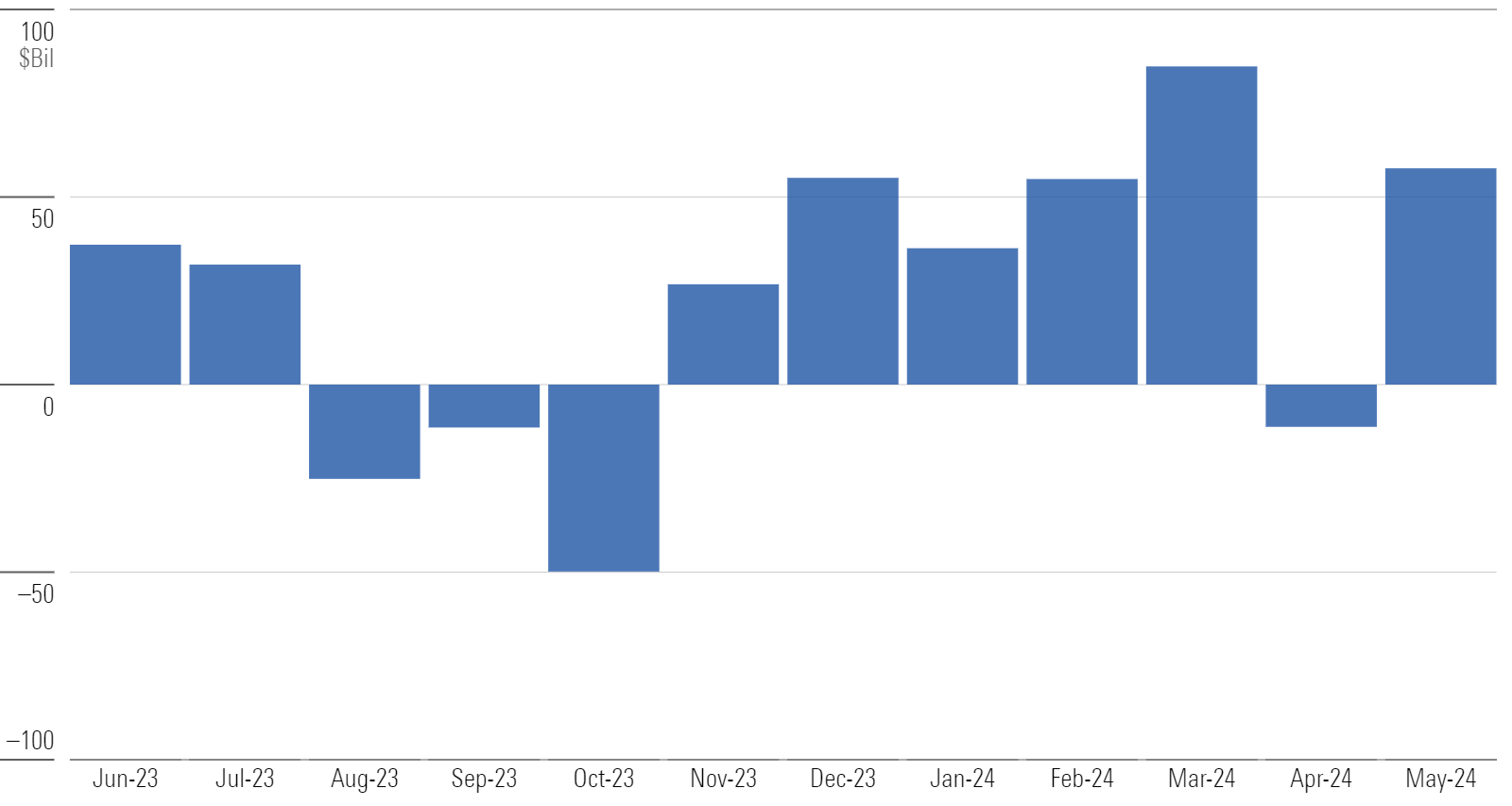

The month of May served as a reminder to get core bond exposure. That’s because funds focused on the debt market saw increased inflows after April’s outflows, resuming the positive trend.

“After a sudden dip in April, US funds took in $58 billion in May. [This marked] a resumption of their prior trend. Demand was broad-based, as seven of the 10 category groups enjoyed inflows,” Morningstar reported.

Long-Term US Fund Flows

As opposed to a passive strategy, active management can get fixed income investors more flexibility that’s almost imperative in a macroeconomic environment predicated on interest rate policy. To quell the uncertainty, deftly navigating the bond market is available in an active fund like the NEOS Enhanced Income Aggregate Bond ETF (BNDI).

BNDI seeks to distribute monthly income generated from investing in a representative portfolio of the U.S. aggregate bond market and implementing a data-driven put option strategy. The active management allows BNDI to maintain pliability and flexibility in any market environment. It simultaneously takes advantage of tax-loss harvesting opportunities.

To extract more income from the market, the fund includes the sale of SPX Index options classified as section 1256 contracts. Those are subject to lower 60/40 tax rates. This is where the fund’s tax efficiency offers investors income while decreasing their tax burden.

BNDI currently has a net expense ratio of 0.58%. The distribution yield is 5.57%. That is calculated by multiplying the most recent distribution by 12 to annualize it. It then dividing by the net asset value of BNDI.

2 Familiar Funds in One Active ETF

Two of the more popular funds when it comes to core bond exposure are the iShares Core US Aggregate Bond ETF (AGG) and the Vanguard Total Bond Market Index Fund ETF Shares (BND). Both present an ideal option to get total bond market exposure. They encompass a wide variety of debt domestically and internationally, and of varying durations and credit risks for diversification.

BNDI offers almost a 50/50 split for exposure between the two funds, thereby allowing investors to obtain that core exposure to supplement their equities portfolios. Additionally, with the income component added with its put option strategy, BNDI adds that additional income component that should help fixed income investors seeking yield.

It all comes under the auspices of active management and in a tax-efficient package. BNDI has an expense ratio of 0.58%

For more news, information, and analysis, visit the Tax-Efficient Income Channel.