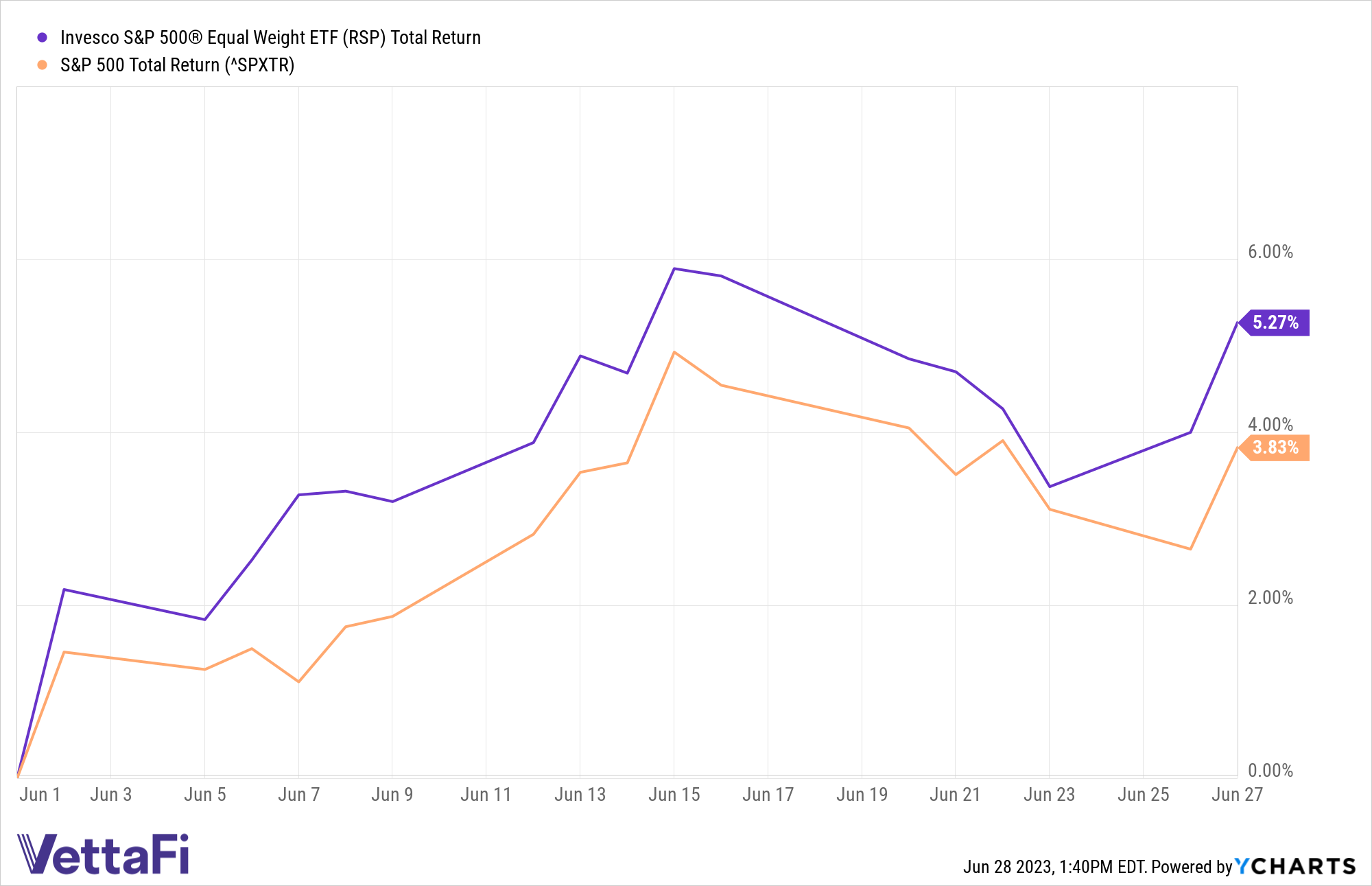

Equal weight is poised to outperform the cap-weighted S&P 500 in June.

With just a few days left in the month, the Invesco S&P 500® Equal Weight ETF (RSP), which tracks the S&P 500 Equal Weight Index, is handily outpacing the benchmark. Equal weight strategies have shown strength this month as market breadth has recently improved.

Month to date, RSP is up 5.3% while the S&P 500 has climbed 3.8% as of June 27. With just three more trading days in the month, RSP is positioned to maintain its lead over the cap-weighted index.

Equal weight RSP versus the benchmark

See more: “It’s the Economy That Matters: The Housing Market”

The fund has garnered significant attention this month. RSP has seen $3.9 billion in net flows in June to date, compared to just $180 million in net flows during the first five months of the year.

Equal weight lagged in prior months as caps dominated indexes positive performance but is well positioned as market breadth improved. Equal weight had a great showing in 2022, when it beat the benchmark by 650 basis points. The fund accreted $5.3 billion in net flows last year as investors looked to diversify away from mega caps and reduce concentration risk.

See more: “Add an Equal-Weight Component To Mid-Cap Exposure”

Why Allocate to an Equal Weight Strategy

Equal weighting effectively removes size bias from a portfolio. Thus, offering more protection if a large company or sector experiences a downturn. Equal weight strategies are best used as a long-term core holding and have historically outperformed over longer durations.

The five sectors with the greatest concentration risk, measured by total weight of the largest five companies, include communication services, information technology, energy, consumer discretionary, and consumer staples. Conversely, the sectors with the lowest concentration in the largest five names are industrials, healthcare, and financials, according to S&P Dow Jones Indices.

For more news, information, and analysis, visit the Portfolio Strategies Channel.